Learn to earn, save, and spend wisely.

Not a Credit Union 1 Alaska member? Click here to join today!

Already have Greenlight? Contact Greenlight Support by calling (888) 483-2645 and ask to be added to the Credit Union 1 Alaska program.

Learn how we collect and use your information by visiting our Privacy Statement.

Learn to earn, save, and spend wisely.

Not a Credit Union 1 Alaska member? Click here to join today!

Already have Greenlight? Contact Greenlight Support by calling (888) 483-2645 and ask to be added to the Credit Union 1 Alaska program.

Learn how we collect and use your information by visiting our Privacy Statement.

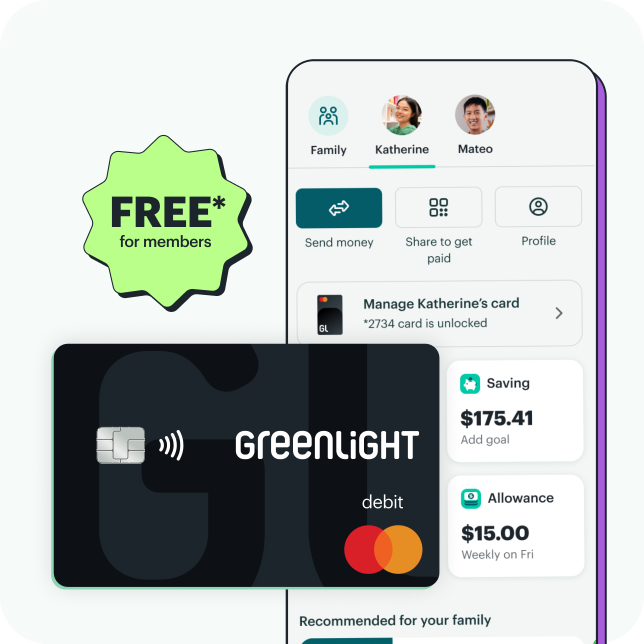

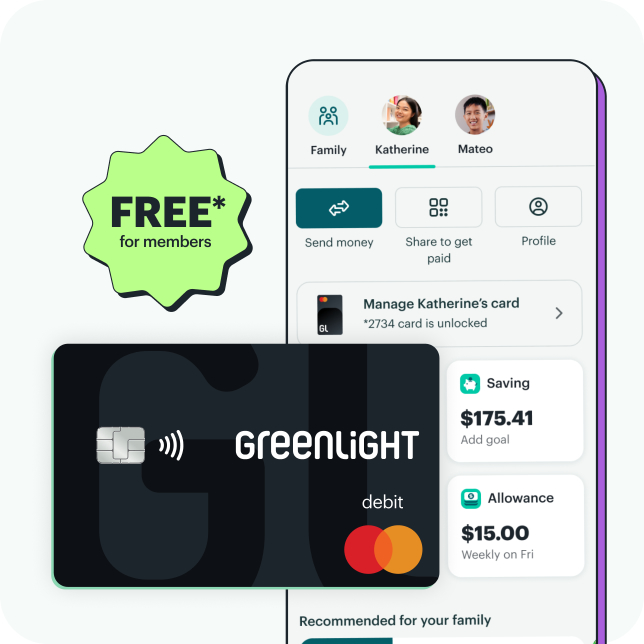

What you get with Greenlight and Credit Union 1 Alaska.

A debit card of their own

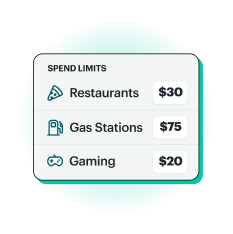

Teach smart spending while you send money, set flexible controls, and get real-time notifications.

Money management

Manage chores, automate allowance, set savings goals together, and more.

Financial literacy game

Play Greenlight Level Upᵀᴹ, the financial education game for kids.

Debit card

Greenlight is the award-winning money app loved and trusted by 6+ million parents and kids. With their own debit card, kids and teens learn to manage money — while you send money to kids, get real-time notifications, and set flexible controls.

Debit card

Build lifelong money skills.

Kids and teens learn to spend wisely while they track their spending and savings — and with the option to create a Custom Card, they can do it in style.

Debit cards are FDIC-insured up to $250,000**

Fraud protection with Mastercard's Zero Liability Program

Parents can block unsafe spending categories

Customer Support is available 24/7

Earnings for hard work.

Chores

Assign chores in the app — and sit back and relax as your kids check them off the to-do list.

Jobs

Got a one-time task? Assign it in the app and your kids get paid when it’s complete.

Allowance

Automate earnings. Pay a percentage based on chore progress — or only if they’re all done.

Direct deposit

Working teens? They can set up direct deposit for simple paycheck management.

Money management

Make saving a habit.

Greenlight makes it easy for kids and teens to send earnings to savings, create custom goals, and share them with friends and family to contribute. Plus, with boosts like Round Ups and Parent-Paid Interest, they can hit their goals even faster.

Money management

Whether they’re graduating or babysitting, kids and teens can share their pay link or QR code to receive money from friends and family — with your approval on every payment.

Financial literacy

Play the educational game that teaches real-world skills.

Greenlight’s in-app financial literacy game for kids and teens blends bite-sized challenges with real-world practice to teach money skills players can use today — and for life.

FAQ

Get started today.

Smart money habits to last a lifetime, courtesy of Credit Union 1. Includes up to 5 kids.

Read how we use and collect your information by visiting our Privacy Statement.