Is Greenlight worth it? 10 reasons to give it a try

Learn how we collect and use your information by visiting our Privacy Statement.

If you're a parent looking for a way to teach your kids smart money habits, Greenlight might be perfect for your family. Greenlight is a financial and educational platform designed to help kids and teens build real-world money skills, like budgeting, saving, investing, and giving, in a safe, supervised way. More than 6 million parents and kids use Greenlight, and 95% of Greenlight parents say it helps teach financial responsibility.

Greenlight offers three plans (Core, Max, and Infinity), each with features designed to help kids and teens learn smart money habits. In addition to a debit card for kids, the app includes tools for managing chores and allowances, as well as parental controls, investing features, savings rewards¹, educational games, and no ATM fees. With Greenlight Infinity, you can even take advantage of robust safety features like location sharing, crash detection, SOS alerts, and driving reports,² giving parents extra reassurance as kids start to explore their independence. However, the tiered monthly subscription may not work for every family’s budget.

So, is Greenlight worth it for your family? Let’s dive in.

10 features that make Greenlight worth it

There are many reasons why families choose Greenlight, but are these reasons enough for you to become a Greenlight user too? Let’s take a look at 10 features that Greenlight customers love.

1. A debit card designed for kids

Greenlight offers a secure debit card that gives kids and teens hands-on experience managing money, all with built-in parental controls. For $5.99 per month, the Core plan covers up to five kids, allowing parents to send money transfers quickly while kids earn cash back on purchases³. Real-time notifications keep you updated on their spending, and you can set limits on where and how much they can spend, adjusting as they grow. Kids can even personalize their debit card with their favorite photo, making it unique to them and a lot of fun to use.

With a debit card of their own, kids and teens learn to spend wisely, keep an eye on balances, and track their spending. Big money dreams? Set savings goals and start investing with as little as $1 — with your approval on every trade.

2. Teaches kids financial literacy

While the debit card for kids is a big part of what Greenlight is all about, there’s more than that to love. Greenlight is also a hands-on financial education tool that teaches kids the basics of earning, saving, spending, investing, and giving, all while building healthy money habits they’ll carry into adulthood. Level Up™, Greenlight’s financial literacy game for kids and teens, has a financial curriculum, interactive challenges, and rewards to make learning about budgeting, investing, and money management fun.

3. Gives parents extra peace of mind

Greenlight’s built-in safety and parental controls let you set flexible spending limits, get real-time transaction alerts, and even block unsafe spending categories. But Greenlight offers more than just financial security, with features like location tracking, crash detection², and identity theft protection.⁴ This is perfect for families with teens learning to drive or starting their first job because it gives parents the tools they need to monitor their child’s whereabouts, track driving behavior, and provide emergency support when needed.

4. Builds independence and responsibility

Greenlight really shines when it comes to helping families manage chores and allowance. As a parent, you can assign recurring chores for up to five kids and let them check completed tasks off as they go. Or, assign a one-time chore and pay them once it’s complete. You can also customize allowances by setting the payout schedule, choosing whether to link it to chores, or fully automating it all, saving you time and making the process seamless. Greenlight’s chores and allowance features help kids connect work with money, teaches them responsibility, and motivates them to explore their independence.

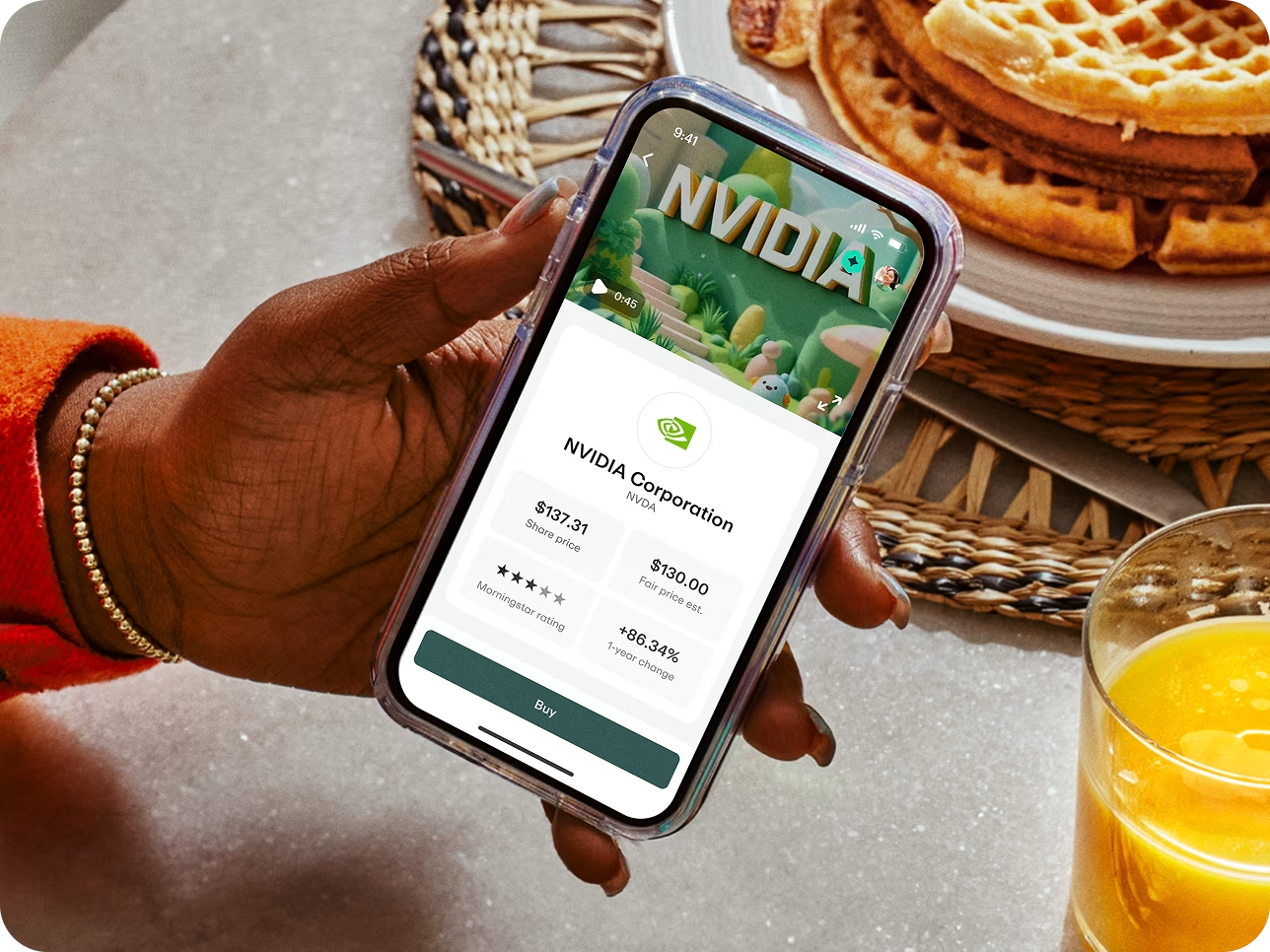

5. Introduces kids to investing

With Investing for Kids, available in Greenlight’s Max and Infinity plans, kids and teens can begin to explore investing in a safe way with no trading fees. They can research stocks and ETFs and buy fractional shares of their favorite stocks (with parental approval, of course!). Plus, with real-time tracking and notifications, parents can stay informed every step of the way.

When kids start investing early, they have the chance to grow their money as they save toward all their future goals. New car. College education. First apartment. You name it.

6. Helps you invest in your child’s future

Greenlight gives kids a head start on smart money management with features like savings goals, parent-paid interest, and cash back on purchases³. By allowing parents to set interest incentives, kids see how their savings can grow over time. Whether they’re working toward a short-term goal or one that’s more long-term, Greenlight helps you invest in your child’s future in a way they can see, understand, and get excited about.

7. Keeps your family connected in one app

Within the Greenlight app, parents can manage chores, automate allowances, track savings, and even introduce their kids to investing. But there are even more features that go beyond money management. Greenlight’s Infinity plan includes all of the core money management features plus family location sharing, SOS alerts, crash detection, driving insights², phone⁴ purchase, and identity theft protection. This makes Greenlight a great financial and safety hub that keeps everyone in your family connected and safe.

8. Teaches smart budgeting with spend categories

Budgeting is one of those skills that kids learn best through hands-on practice — and Greenlight makes it straightforward. Instead of abstract lessons, kids use real money, guided by parents. You can set spending categories like lunch money, entertainment, or gas, and put limits in place that help kids see firsthand how to balance what they want with what they really need. It's a practical way to build good financial habits they'll actually use later in life.

9. Encourages charitable giving

The Giving category feature in Greenlight helps kids make charitable giving part of their money habits. Kids can easily set up a Giving account, where they can move some of their money to designate it for charitable giving. The Greenlight app connects to Charity Navigator, a non-profit company that evaluates charities so you can make donations you feel good about — and kids can make a donation with as little as $10. This helps them understand that managing money isn’t just about spending and saving; it’s also about making a difference.

10. Grows with your child

Kids grow up, and Greenlight’s features grow with them. Little kids can begin with simple savings goals and learning how to manage their allowance. Older kids and teens can explore investing, set up direct deposit from their first job, and practice budgeting for college. This makes Greenlight a great companion for your kids that helps them prepare for every stage of life that’s ahead.

Both you and your kids download the Greenlight app — with tailored experiences. They check off chores, you automate allowance. They spend wisely, you set flexible controls. They build healthy financial habits, and you cheer them on.

Is Greenlight worth it for you?

If you're looking for an app that's both educational and secure, with lots of ways to encourage smart financial choices, Greenlight could be a great fit. If you prefer a simpler, subscription-free option, opening a traditional bank account for your kids may be a better option for your family.

Families with kids just starting to manage money, teens preparing for financial independence, or even young drivers who need an added layer of safety will likely get the most from Greenlight’s all-in-one platform. Give it a try today!

Real families, real results. Join 6+ million financially smart kids, teens, and parents learning to earn, save, and invest together! Try Greenlight, one month, risk-free.†

Join Greenlight. Love it or it's on us.†

Plans start at just $5.99/month for the whole family. Includes up to five kids.

Read how we use and collect your information by visiting our Privacy Statement.