7+ valuable life lessons a Greenlight card can help teach your kids

Learn how we collect and use your information by visiting our Privacy Statement.

By Alyssa Andreadis

Key takeaways

Greenlight gives kids and teens money skills they’ll actually use for life.

From saving and spending to investing, they get hands-on experience with managing money.

Parents stay in control while helping their kids build confidence and financial know-how.

As parents, one of the best things we can teach our kids is financial literacy and how to make smarter money choices. But that’s not always easy to do. This is where the Greenlight card comes in. Greenlight is a debit card and app designed for kids and teens so they can practice how to earn, save, and spend money while parents stay in the driver’s seat. It helps families start important money conversations early, in a way that makes sense to kids.

So what can the Greenlight card actually teach your kids? Let’s take a look.

7 awesome lessons the Greenlight card can teach your kids

Here are seven money lessons the Greenlight card and app can help teach kids that will stick with them for years to come.

1. Budgeting for real life

When your kids get their Greenlight debit card and log into the app, they’ll have access to financial literacy education that’s fun. Kids and teens can split their money into categories: spend, save, and give. This teaches them the importance of budgeting, goal setting, and planning ahead for purchases. And, it becomes a great way to help them understand needs vs. wants.

2. Saving towards a goal

Greenlight’s visual savings goals within the app can help motivate progress. Your kids can see how much money they have and decide how much to put into their savings category. If they know they need a certain amount of money to make a specific purchase, they quickly learn how to be patient and delay gratification… because spending it all now means waiting even longer for what they really want.

With a debit card of their own, kids and teens learn to spend wisely, keep an eye on balances, and track their spending. Big money dreams? Set savings goals and start investing with as little as $1 — with your approval on every trade.

3. Smart spending habits

When your kids get their own debit cards, they learn what it means to make purchases all on their own. They can spend their money on the things they want, but parents can control the stores they can buy from and get instant spending alerts. This gives kids and teens a taste of real financial responsibility but with their parent's guidance surrounding the entire experience.

4. Earning money through chores and allowance

One key feature of the Greenlight app is the ability to manage chores and allowance. Parents can assign chores and then automatically pay their kids when the chores are complete. This teaches kids how to connect work with earning money, and helps them start to understand the meaning of income.

5. Financial responsibility

Greenlight has a built-in game called Level Up™ that makes learning about money really fun. It breaks down financial terms in a way that’s easy for kids to understand and encourages them to take responsibility for their own choices. It’s a great way to help them start thinking independently about money.

6. Giving back

Helping kids understand the value of giving can be just as important as teaching them to save or spend wisely. Greenlight makes it easy for them to set aside part of their allowance to support causes they care about. Kids can research and select a charity to make a donation to right in the app. When they are ready to donate, they’ll be taken out of the app to Charity Navigator to complete their donation.

7. Learning the ins and outs of investing

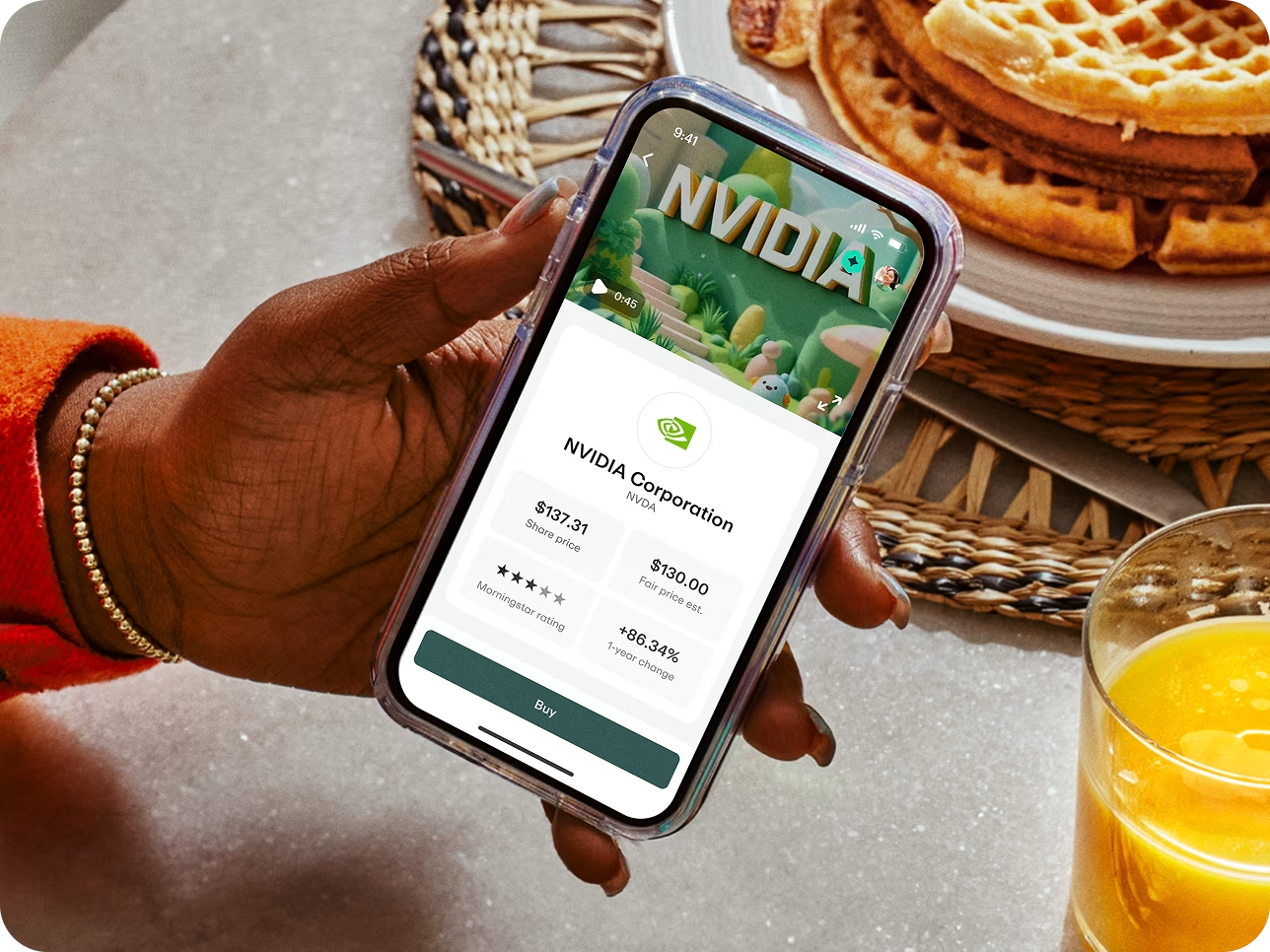

With the Greenlight Max and Infinity plans, kids can learn the basics of stocks and investing. Through Investing for Kids, they’ll learn how stocks work and start to understand how investments can grow over time. Parents approve every trade, so the experience stays safe and educational.

When kids start investing early, they have the chance to grow their money as they save toward all their future goals. New car. College education. First apartment. You name it.

How Greenlight helped my family learn about money

When I first signed up for Greenlight, I was looking for a better way to manage chores and allowance. What I didn’t expect was how many money lessons my kids would pick up along the way. Here's our story... and a few of the things my kids have learned since we started using the app.

As a single mom with three kids, I was desperate for a way to get them to pitch in more around the house. I started with a chore board on the kitchen wall, just a classic weekly chart showing who was responsible for what. It sounded great! But someone was constantly bumping into it and erasing half of my carefully planned assignments. I tried keeping a running log of who completed their chores each week, but that was exhausting. And, don’t even get me started on the weekly scramble for small bills to pay their allowance. Who carries cash anymore? It quickly turned into more work for me… and zero motivation for them.

Lesson 1: Earning money means doing the work

Then I came across Greenlight, and the app seemed like it was made just for us. Chores and allowance all in one place that they couldn’t “accidentally” erase? A place to keep everyone in the loop on what I expected from them? An easier way to track allowance payments? Yes, please! I created an account for each of my kids, set up and assigned our recurring weekly chores, and (this was the most amazing part) automated their weekly allowance payouts. If they don’t complete their chores, they don’t get paid. And they can track their progress in the app, too, and see how close they are getting to the money. Talk about motivation!

Lesson 2: Spending money means making choices

While I jumped on board with Greenlight because of the ease of managing chores and allowance, there were so many other benefits once we got started with the app. One of the first things that really stood out? Debit cards for the kids! This is great for me because it eliminates the need for cash, but even better for them because having a debit card as a kid makes them feel grown-up. And, it comes with real responsibility. They can now use their card to buy things with their hard-earned allowance money (I can control where they spend it and get alerts when they do). But they quickly learned that if they spent an entire month of allowance on candy and snacks, then they would have to wait to buy something more costly that they really wanted.

Lesson 3: Saving feels pretty rewarding

My kids started to make the connection between spending and the consequences of their purchases pretty quickly. This opened the door to talk with them about the importance of saving. Greenlight helped with that, too. There is tons of educational information in the app that explains in kid-friendly terms why it’s important to save and how to do it. And I can even give them a little extra motivation with parent-paid interest (which is a great opportunity to teach them about compound interest!).

Lesson 4: Building smart money skills doesn’t have to be boring

What started as the perfect fix to our messy chore and allowance system turned into something so much better. My kids are helping out around the house more (so they can earn more!), tracking their progress in the app, learning how to manage their money, and making better choices. Greenlight made those lessons part of our everyday lives in a way that’s easy and fun for them. It’s like a game they don’t want to put down. Greenlight has been a great tool to teach them the kind of financial skills I wish I had learned earlier!

Both you and your kids download the Greenlight app — with tailored experiences. They check off chores, you automate allowance. They spend wisely, you set flexible controls. They build healthy financial habits, and you cheer them on.

Why Greenlight?

Greenlight isn’t just a debit card. It’s a platform for teaching financial literacy that grows with your kids. When they learn how to budget, save, spend, give, and even invest, they are learning key skills for life. And the best part? You don’t have to do it alone. Greenlight makes it easier to guide your kids toward smart money habits, every step of the way.

Reach $ goals together. Teach your kids about saving for life's big moments with Greenlight’s award-winning money app. Try Greenlight, one month, risk-free.†

Join Greenlight. Love it or it's on us.†

Plans start at just $5.99/month for the whole family. Includes up to five kids.

Read how we use and collect your information by visiting our Privacy Statement.