Cash in now on our newest Savings Boosts

Hey, $mart parents 💡

Bring money lessons home with Greenlight’s $mart Parent newsletter, a quick read with impactful tips — delivered free to your inbox weekly.

WOAH. Get ready to grow your money. Greenlight now has five ways to boost your Savings.

Talk to your parents about the best ways for you to save — including our two latest Savings Boosts: 1% Cash Back to Savings and 3% Greenlight Savings Reward.* Read on to see how you can save big with Greenlight.

1. Savings Goals

It all starts with Savings Goals, because dreams need action plans. Greenlight empowers you to set your own Savings Goals big and small — everything from AirPods and roller skates to a first car and college.

With our new Savings Boosts (Cash Back to Savings and Greenlight Savings Reward), you earn a little extra money to put toward those goals. Every bit counts.

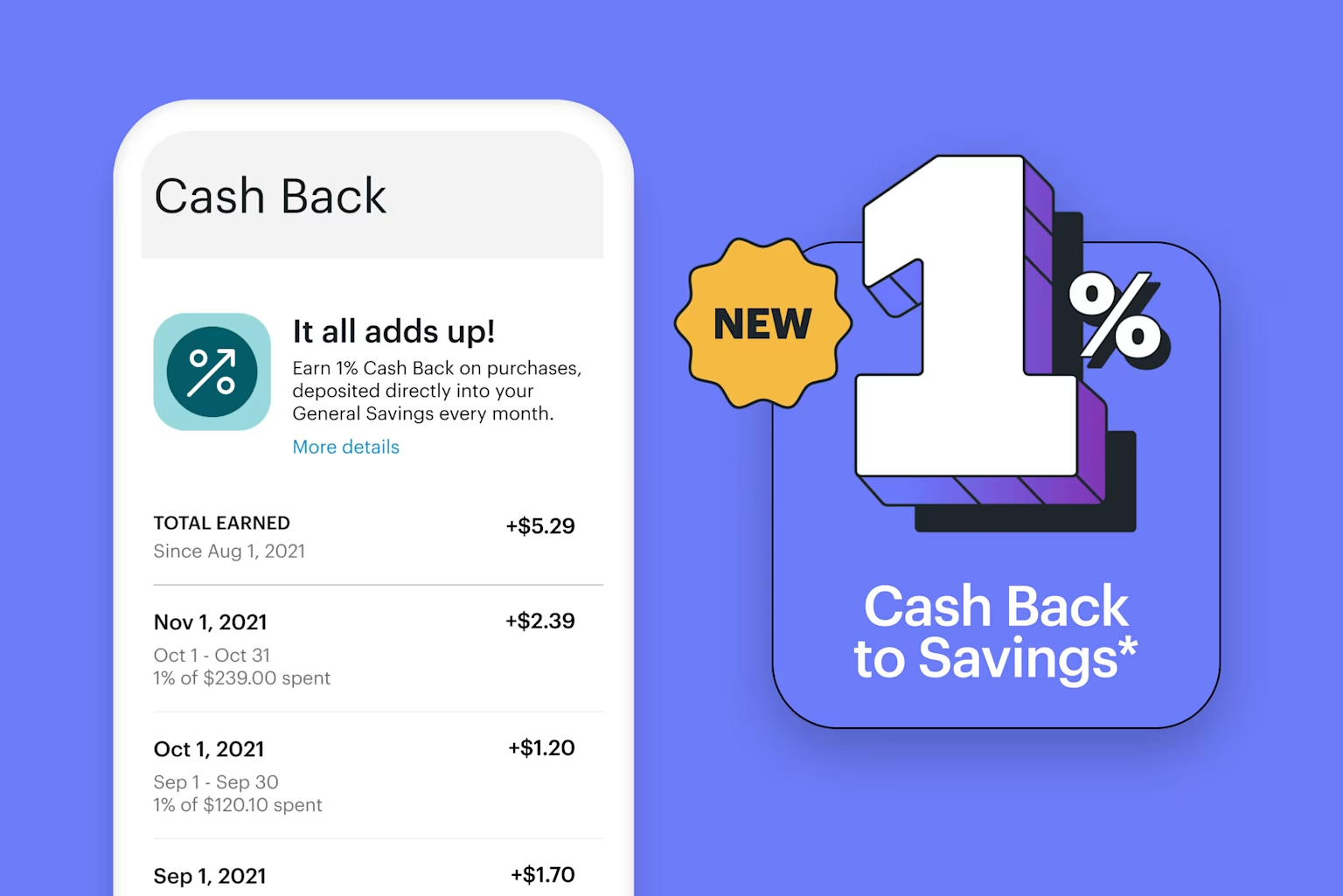

2. Cash Back to Savings

Not all cards give you cash back when you spend. Which is why we’re thrilled that Greenlight Max kids get 1% on every purchase — deposited into Savings. It’s smart to choose cards that reward you with incentives, because that way, your money works harder for you.

To earn 1% cash back, your parents will need to connect a bank account as your funding source and switch your plan, if you aren’t already a Greenlight Max family.

3. Greenlight Savings Reward

With Greenlight Savings Reward, earn up to 5% on Savings automatically.* You’ll see compounding interest in action and why it pays to save. Compounding means earning money on the interest you’ve earned. So your money makes more money over time.

Every family is eligible to earn 1% with their connected bank account. To increase your rewards to 5%, you’ll need to be on the Greenlight Infinity plan. Start earning now! Both Cash Back to Savings and Greenlight Savings Reward began monthly payouts in September 2021.

4. Round Ups

With Round Ups, round up purchases to the next dollar and add the change to your Savings. You're saving while you're spending.

It may sound small, but let’s talk about how cents add up. *Grabs calculator.* If you pay $4.30 for a smoothie, 70 cents automatically goes to Savings. 10 smoothies later and you’ve already saved $7. Boom. Savings supercharged.

5. Parent-Paid Interest

Here’s how parents can provide an extra boost to your Savings. Parent-Paid Interest allows them to add a financial reward to your Savings at a rate of their choice.

The higher the rate, the faster Savings grow. Tell your parents what you learned about compounding interest, and maybe they’ll want to chip in to keep the incentive going.

Get the most out of Greenlight

Watch how $75 in Savings could grow to more than $81 in one month. That’s an extra 6 bucks you didn’t have. Let’s add it up with Savings Boosts — all on autopilot with Greenlight. If monthly spending was $40 that month:

Initial Savings: $75 Change from Round Ups: $5.15 1% Cash Back to Savings: $0.40 3% Greenlight Savings Rewards: $0.13 10% Parent-Paid Interest: $0.63

Extra saving: $6.31. New balance: $81.31. And that’s before you add more money to your Savings Goals.

What’s next? First, take a bow — you’re becoming smart about money. Next, talk to your parents about how you can make the most of your Savings. If they have questions about Cash Back and Greenlight Savings Reward, send them to our handy Rewards FAQ page.

*Greenlight Core families can earn 2% per annum, Greenlight Max families can earn 3% per annum, Greenlight Infinity families can earn 5% per annum, and Greenlight Family Shield families can earn 6% per annum on an average daily savings balance of up to $5,000 per family. To qualify, the Primary Account must be in Good Standing and have a verified ACH funding account. See Greenlight Terms of Service for details. Subject to change at any time. **Greenlight Max, Infinity, and Family Shield families can earn 1% cash back on spending monthly. To qualify, the Primary Account must be in Good Standing and have a verified ACH funding account. See Greenlight Terms of Service for details. Subject to change at any time. ***Requires mobile data or a WiFi connection, and access to sensory and motion data from cell phone to utilize safety features including family location sharing and driving alerts and reports. Messaging and data rates and other terms may apply.

Share via