GoHenry (now Acorns Early) vs. Greenlight: Which app is best for your family?

Learn how we collect and use your information by visiting our Privacy Statement.

Teaching your kids financial skills is easier than ever with family debit cards and money apps, where you can set chores and allowances, track savings goals and spending, and even learn how to invest from an early age.

Greenlight and GoHenry (now known as Acorns Early) are two of the most popular debit cards for kids, both designed to help parents teach kids smart money management through hands-on learning. While they share many similarities, there are key differences in features, prices, and flexibility. Here, we break down the details of each to help you decide which is best for your family.

Features comparison

Both GoHenry and Greenlight come with similar core features like the debit card, allowance automation, chore assignments, and basic parental controls. But Greenlight gives you the option to upgrade beyond the basics with features like cash back on savings¹, cashback rewards², location sharing³, and driving reports³ that make it more of a one-stop experience.

Greenlight vs. GoHenry | Greenlight | GoHenry |

|---|---|---|

Pricing | Starts at $5.99 / month for up to 5 children | Starts at $5.00 / month for 1 child |

Debit card for kids | ||

Allowance & chores | ||

Data sharing | Your child’s data is safe with Greenlight and not shared with anyone. | May share user data with affiliates and third-party service providers. |

Category-specific parental controls | ||

Upload your own custom card photo | ||

Up to 5% on savings¹ | ||

Up to 1% cash back² | ||

Family location sharing and SOS alerts³ | ||

Driving reports, alerts, and crash detection³ |

Pros and cons of Greenlight vs. GoHenry

Both apps deliver core features like parental controls, spending notifications, automated allowance, chore trackers, investing options, and educational tools. However, notable differences in cost, customization, and savings incentives set them apart.

GoHenry at a glance

GoHenry, now known as Acorns Early, is a debit card and money app that leans heavily into education and family money management. With only two price tiers based on the number of kids, GoHenry is a great beginner choice when it comes to simplicity, educational tools, and affordability.

Where GoHenry falls short is when it comes to extra features like cash back and more extensive safety protections parents may want to add as kids grow.

GoHenry core features

Debit card for kids 6 to 18

Customizable chores and allowance by age

Allowance management

Parent-paid interest

Parental money controls

GoHenry pros:

Lower cost for basic card compared to Greenlight

Both plans offer the same set of features

Assign chore-specific payments

Extensive financial education resources (no additional cost) including courses, videos, quizzes, and age-specific missions

“Pay kids to learn” options

Customized card designs start at $5

GoHenry cons:

Limited to ages 6 to 18

No savings incentives (parent-paid optional)

No cash-back rewards

No in-app investment platform (you must have an Acorns Gold account to access Acorns Early Invest)

Not available to residents of U.S. territories

May share user data with affiliates and third-party service providers for business, marketing, and analytics purposes

Greenlight at a glance

Greenlight is a feature-packed debit card and money management app that helps parents teach kids how to earn, spend, and save wisely. Greenlight offers four plans and prices: Greenlight Core, Greenlight Max, Greenlight Infinity, and Greenlight Family Shield. All four include the same core features, including up to 2% savings rewards¹. But you’ll need to subscribe to a higher tier to unlock some of Greenlight’s other valuable features, like cash back, higher savings rewards, the Investing for Kids platform, and safety and security tools.

Greenlight core features

Debit card for up to 5 kids

Allowance management

Chore scheduling and tracking

Up to 2% on savings¹

Level Up™ financial literacy game and The Learning Center, an educational blog

Parental money controls

Greenlight pros:

Multiple plan and price options by feature

All plans cover up to 5 kids regardless of cost

Open to all ages

Up to 6% on savings¹

1% cash back on purchases²

Auto-blocks certain vendors (lotteries, massage parlors, etc.)

Investing for Kids (research and propose trades with parent approval)

Robust Learning Center and Level Up™ money game (no additional cost)

Phone⁴, purchase, and identity theft protection^

Family location sharing, SOS alerts, and driving reports³

Does not share user data with anyone

Greenlight cons:

Higher core plan costs of $5.99

Must upgrade to Greenlight Max, Greenlight Infinity, or Greenlight Family Shield plans to access advanced features like cash back, investing, and up to 6% on savings

Customized debit cards are $9.99

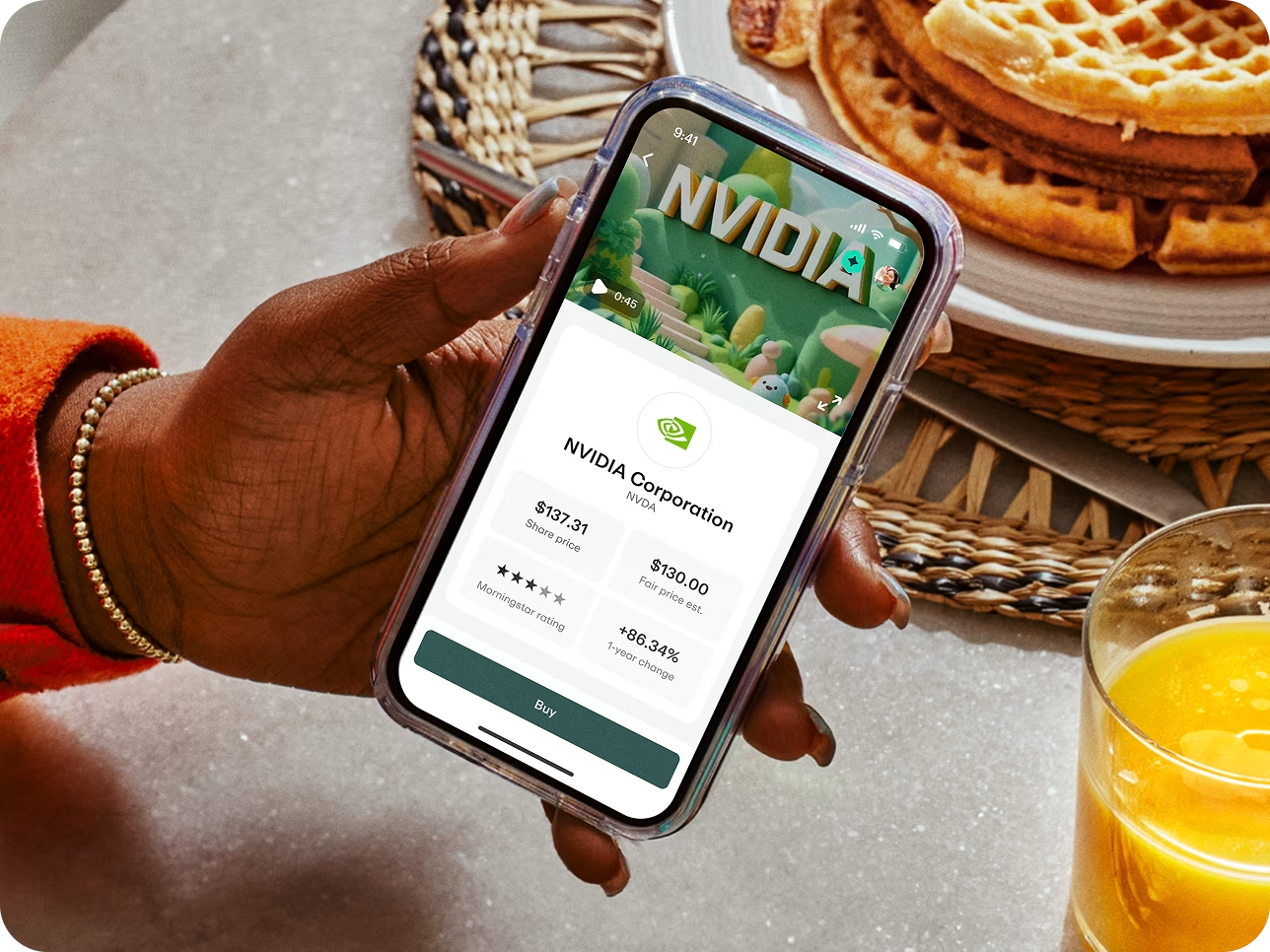

With a debit card of their own, kids and teens learn to spend wisely, keep an eye on balances, and track their spending. Big money dreams? Set savings goals and start investing with as little as $1 — with your approval on every trade.

Pricing

At the basic level, GoHenry costs less than Greenlight by $1 a month, although GoHenry only offers two plan tiers, while Greenlight has four. At the tier 2 level, GoHenry and Greenlight are priced the same, but Greenlight delivers substantially more benefits and features.

Overall, GoHenry is a good value if you have a smaller family or just want the basics – debit cards, parental controls, and age-tiered financial education resources. But, Greenlight may be a better value for bigger families or those who want more features like interest on savings, cash back, and security protections.

GoHenry (Acorns Early) pricing

GoHenry offers two plans by family size. Both plans deliver the same features.

$5/mo. for one child

$10/mo. for 2 to 4 kids

Greenlight pricing

Greenlight offers four plans based on features and benefits. Each covers debits cards up to five kids, with a core set of tools and protections.

Core: $5.99/mo.

Max: $10.98/mo.

Infinity: $15.98/mo.

Family Shield: $24.98/mo

Who wins?

GoHenry has a lower price point, but Greenlight provides a lot more features for the cost. So if you're considering cost alone, GoHenry might be the better option. But if you’re looking for extra features like cash back, savings rewards, and investing, Greenlight would be the better choice.

Parental controls

GoHenry (Acorns Early) and Greenlight offer similar in-app parental controls, but Greenlight has a few more specific and customizable features.

Greenlight parental controls

Store- and ATM-level parental controls

Category-specific parental controls

Flexible spending limits and real-time notifications

Block unsafe spending categories

Block specific retailers

Parental approval for money sent via Greenlight Pay Link

GoHenry (Acorns Early) parental controls

Flexible spending limits and real-time notifications

Card declined alerts

Block specific retailers

Parental approval for money sent via Giftlinks or Relative Accounts

Who wins?

Greenlight edges out GoHenry with more granular parental controls, including category-specific restrictions and ATM-level controls.

Earning and saving

When it comes to earning and saving, Greenlight has a clear edge with cashback and savings rewards. In comparison, GoHenry lets you set parent-paid interest on savings but offers no additional incentives.

Greenlight earning and saving features

Set savings goals

Automate savings and allowance

Savings rewards up to 6%¹

1% cash back on purchases² (with Greenlight Max, Infinity and Family Shield plans)

Assign and track chores

Connect allowance to chores (optional)

Optional Round-Up rules (send change from transactions right to savings)

GoHenry (Acorns Early) earning and saving features

Set savings goals

Automate savings

Automate allowance

Assign chores and payouts

Parent-paid interest options

Who wins?

Greenlight wins this category with savings rewards, cash back on purchases, and the ability to connect allowances to specific chores. It provides real financial incentives that are not available with GoHenry.

Investing

Both GoHenry (Acorns Early) and Greenlight offer an investing component, but you can only access GoHenry’s if you have an Acorns Gold account. Greenlight includes its Investing for Kids platform with higher-tier plans and a scaled-down version for parents with the Greenlight Core plan. Given that Greenlight Max is $10.98 and Acorns Gold is $12/month, Greenlight may be a better value if you want to teach your kids about investing.

Greenlight investing features

Invest for Parents “Lite”: Parents can choose from 10 selected EFTs and start investing with as little as $1, with no hidden trading fees.

Investing for Kids: In the Greenlight Max and Infinity plans, kids can get in on the action with Investing for Kids — a platform where kids learn to invest and parents approve every trade. Kids can research their favorite stocks and EFTs and buy shares with as little or as much as they’re comfortable with — once parents give the OK, of course.

New investing dashboard. A redesigned dashboard that shows potential future earnings and trending stocks among Greenlight families.

AI-powered support. An in-app AI Assistant answers questions about stocks and ETFs, while smart insights highlight key details.

Analyze tool. A guided experience with three interactive questions that help kids decide whether a stock or ETF is a good fit, with context based on their own risk profile.

GoHenry (Acorns Early)

Acorns Early Invest is available to Acorns Gold account holders ($12/month).

Currently, there is no option to add the Invest product outside Acorns Gold

Who wins?

Greenlight wins because it offers investing features directly in the app, while GoHenry requires a separate $12/month Acorns Gold subscription.

When kids start investing early, they have the chance to grow their money as they save toward all their future goals. New car. College education. First apartment. You name it.

Security and safety

Both apps provide the same core fraud protection. But, Greenlight offers substantially broader safety and security measures for identity theft, phone and purchase protection, and even a physical safety package in its higher tiers.

Greenlight safety and security features

Fraud protection from Mastercard®’s Zero Liability Protection Policy

Customer support 24/7

Additional security through Greenlight Max and Infinity:

Identity theft protection**: Theft monitoring, alerting, and restoration for the whole family.

Cell phone protection⁴: Coverage for damaged, lost, or stolen phones for up to 5 kids.

Physical safety through Greenlight Infinity:

Family location sharing³: Switch on location sharing to stay connected with your family.

SOS alerts³: Send an alert to emergency contacts, 911, or both with one swipe.

Crash detection³: Your app will dispatch 911 when a crash is detected.

Driving reports³

GoHenry security features

Zero Liability Protection by Mastercard

FDIC-insured up to $250,000 through a partner bank

Real-time spending notifications

Block unsafe spending categories

Access app with a code

Fingerprint and facial recognition

Chip and PIN-protected transactions

Secure PIN recovery in the app

Bank-level encryption

Block lost or stolen cards

Who wins?

Greenlight pulls ahead on safety. In addition to fraud protection, it also includes identity theft monitoring³, phone protection⁴, and family safety features such as crash detection and SOS alerts³.

Education and financial literacy

Managing money in real-time is just one part of learning smart money habits – educational features like games and in-app content can help further financial literacy. GoHenry (Acorns Early) and Greenlight offer educational tools for kids and families about money. Here’s how they differ.

Greenlight educational features

Greenlight Level Up™ is an in-app game where kids can build the foundations of financial literacy. It includes interactive challenges developed with a best-in-class educational curriculum by certified financial education experts. The game is included with all three of Greenlight’s plans, at no additional cost.

The Greenlight Learning Center, where families can learn more about money management and personal finance basics.

Outside the app, Greenlight also offers free financial education lesson plans for teachers.

GoHenry (Acorns Early)

Age-tiered money lessons

Videos, quizzes, and teen Money Missions

Learning incentives like hints, badges, and points

Pay kids to learn (optional in parent app)

Who wins?

This one ends in a tie since both apps offer robust educational content for kids to learn about money management and responsibility.

The Verdict

Choosing Greenlight vs. GoHenry depends on your family’s unique needs. If you’re looking for a good basic money management app with interactive, age-specific educational tools, GoHenry is a solid option. But if you want a one-stop app with savings and cash rewards and robust feature options like parent-approved investing, location sharing³, crash and SOS alerts³, and purchase protections4, Greenlight is a great all-in-one solution.

Both you and your kids download the Greenlight app — with tailored experiences. They check off chores, you automate allowance. They spend wisely, you set flexible controls. They build healthy financial habits, and you cheer them on.

FAQs

Join Greenlight. Love it or it's on us.†

Plans start at just $5.99/month for the whole family. Includes up to five kids.

Read how we use and collect your information by visiting our Privacy Statement.