7 features that make Greenlight Investing fun and safe

Learn how we collect and use your information by visiting our Privacy Statement.

Key takeaways:

Greenlight’s redesigned investing platform makes it simple for families to learn and start investing together, from kids learning how the stock market works to parents managing their own portfolios.

AI-powered insights, videos, and education-focused interactive tools help kids (and parents) understand each investment.

Kids can start with as little as $1, parents approve trades, and everyone learns along the way.

Getting kids started with investing can feel intimidating. Stocks, ETFs, and risk are a lot to unpack, even for adults. That’s why starting early matters. A teen who invests even a little each month could end up with nearly three times more by midlife than someone who waits just ten years to begin.

That’s where Greenlight comes in. With its redesigned investing experience, kids and teens don’t just learn the ins and outs of the stock market; they get to try it out in a safe, guided way. Parents approve every trade, kids use their own earnings, and families can explore tools built to make investing simple and engaging for every age.

How Greenlight Investing works for families

Greenlight Investing1 is packed with tools that help kids learn the ropes while giving parents oversight. Here are the features that make it an excellent platform for families.

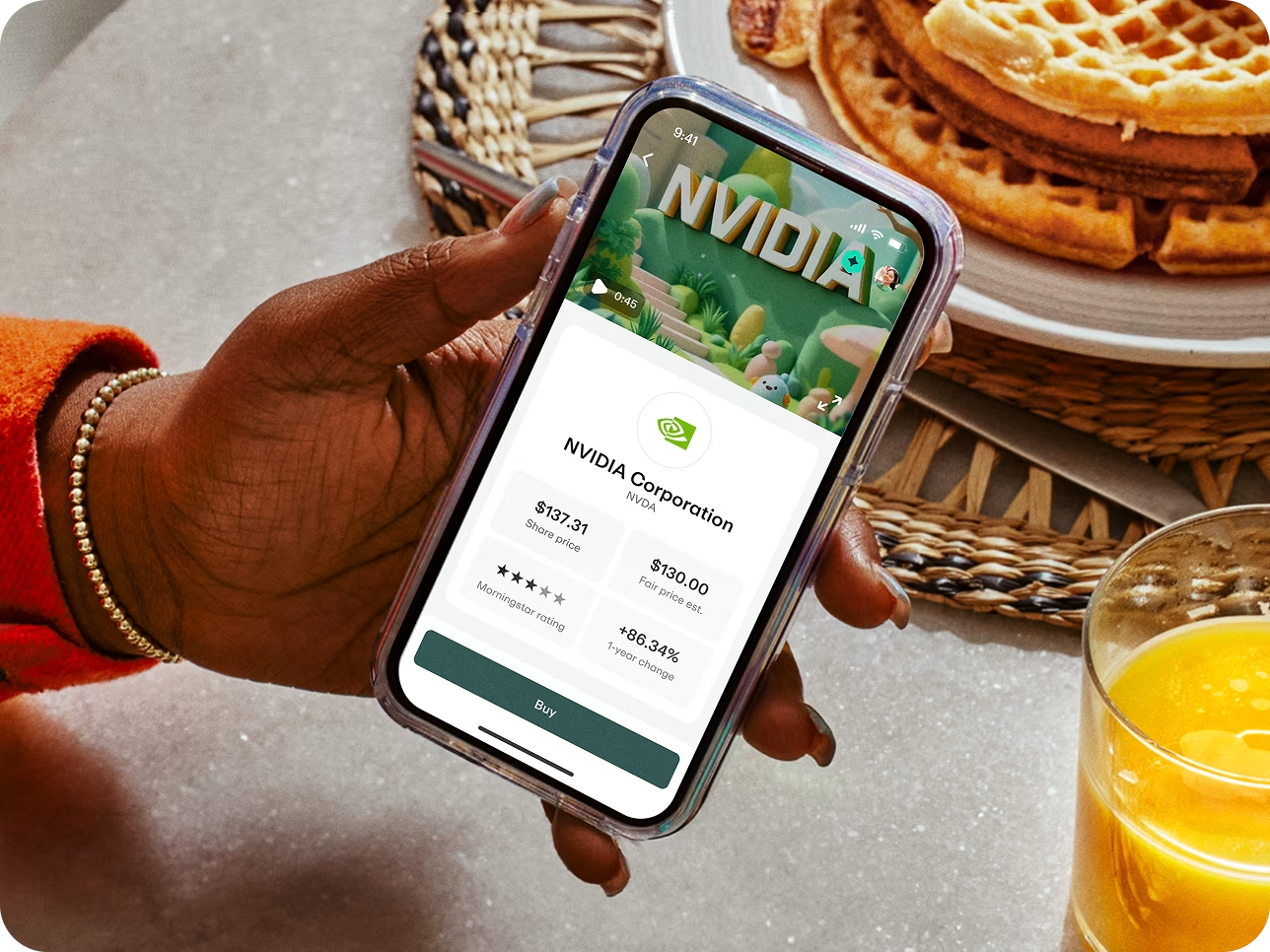

1. Research 4,000+ stocks and ETFs

With Greenlight, kids and parents can browse more than 4,000 stocks and ETFs —the same types of investments adults use to build long-term wealth. To make sure it’s approachable, each company page has clear explanations and videos that show what the business actually does.

Instead of trying to figure out complicated financial charts, kids get an age-friendly view that makes it easier to connect the dots. If your child loves a brand (maybe Nike, Starbucks, or Apple?), they can learn what’s behind the logo, see how the company makes money, and start to understand what it means to own a share of it.

2. Get AI-driven personalized investing insights

A major part of investing is determining if an investment makes sense for you. Greenlight’s redesigned platform gives families a set of innovative tools to make the process easier.

AI-driven insights break down complex stock numbers and data into simple, personalized takeaways.

The built-in Greenlight AI Assistant answers questions in plain language, so kids (and parents) can ask things like, “How risky is this stock?” or “What does this company actually do?”

When it’s time to decide, the Analyze tool walks you through three guided questions about fit, risk, and performance, ending with a “buy” or “pass” summary.

When kids start investing early, they have the chance to grow their money as they save toward all their future goals. New car. College education. First apartment. You name it.

3. Start investing with as little as $1 (and no fees!)

Big investments aren’t required here. Greenlight lets kids buy the fractional shares they choose, allowing them to start with just a dollar. There are no fees for trading or commissions, so every bit of their money goes toward the investment itself.

That makes it easy for kids to put portions of their allowance, birthday money, or savings into companies they care about (always with parent approval, of course). With these safety options, they can jump in early, build confidence, and see how small amounts can grow.

4. Invest money kids earn through Greenlight

Money kids earn through chores, allowance, or gifts doesn’t have to stop at spending or saving. With Greenlight, they can move that money into their investing account and decide where to put it.

The connection between earning and investing helps kids see the bigger picture. They’re using their own allowance to own a piece of the companies they know and love. It turns everyday money moments into real investing lessons.

5. Teach kids the ins and outs of investing

With Greenlight, kids can actually try investing. First, they can look up a company. Then, they put in a trade request for parent approval. Finally, they can watch what happens in their portfolio.

Parents can keep an eye on things, but kids get the front-row seat. That kind of practice gives kids confidence and makes the lessons stick in a way a textbook never could.

With a debit card of their own, kids and teens learn to spend wisely, keep an eye on balances, and track their spending. Big money dreams? Set savings goals and start investing with as little as $1 — with your approval on every trade.

6. Parents approve every trade

Kids can do the research and request trades, but parents have the final say. Nothing goes through without approval, so kids get room to practice while parents stay in control.

It’s a simple setup that gives kids independence without leaving parents out of the loop.

7. Made for kids, but useful for parents too

Greenlight’s investing platform is made with kids and teens in mind, but it’s not watered down. Parents can use the same research to manage their own investments right alongside their kids. That way, the app becomes a family hub. It's one place where everyone in the family can grow their money together.

Greenlight Investing turns money lessons into real experiences. Kids can put their own dollars to work, explore companies they recognize, and see how the market moves day to day, all while parents keep a guiding hand on the process. It’s a safe way to start building financial confidence early, and a simple hub parents can use right alongside their kids.

Want to raise savvy investors? With Greenlight, kids get real-world experience under your guidance. Try Greenlight, one month, risk-free.†

By: Alyssa Andreadis

Alyssa Andreadis is a writer with more than 25 years of marketing experience and is passionate about helping families feel confident with money. She’s written hundreds of articles on personal finance, parenting, and financial literacy. A single mom raising three money-smart teens, Alyssa brings a real-life perspective to her work. She lives in Pennsylvania and always has a knitting project in progress.

FAQs

Join Greenlight. Love it or it's on us.†

Plans start at just $5.99/month for the whole family. Includes up to five kids.

Read how we use and collect your information by visiting our Privacy Statement.