What is panic selling? A family guide to emotional investing

Hey, $mart parents 💡

Bring money lessons home with Greenlight’s $mart Parent newsletter, a quick read with impactful tips — delivered free to your inbox weekly.

Investing in the stock market can feel like a roller coaster. When the market keeps going higher, you might start to feel invincible. But when it suddenly starts going low, panic can take over quickly.

Emotions can lead to short-sighted decisions that could hurt your investment portfolio before you even know what’s happening. Once you learn to spot panic selling and why it occurs, you’ll be more prepared to make choices in the best interest of your long-term financial future.

What is panic selling?

For most families, their investment strategy is long-term, meaning short-term changes shouldn’t dramatically affect how they invest money. Of course, that’s sometimes easier said than done.

Panic selling happens when you make investment changes or choices because you’re afraid stock market prices will fall, or continue to fall – not because your plan or the investments themselves have changed.

And, because stock market pricing is based on supply and demand, panic selling can be contagious, leading to more people selling and prices falling further. It’s similar to when someone yells “Fire!” inside a crowded building, causing everyone to rush out in a panic, whether there’s a fire or not.

Why do people panic sell?

Panic selling goes a bit deeper than unchecked emotions. Typically, it falls into one of the following categories:

Loss aversion: Psychologically, some people feel more pain from losing money than from gaining it.

Herd behavior: If others are getting out of the market, we might see it as social evidence that we too should sell our investments and get out of the market.

Recency bias: People often give more weight to recent events. So, if the market is going down, even after a long period of positive gains, they might focus more on the recent losses.

Personality: Some of us are naturally more cautious or more risk-taking. If you know you’re prone to react quickly to drops, design your plan to work with that tendency. Learn more about navigating financial risk.

How panic selling can backfire

Trying to time the market often costs investors time and money. Panic selling is one of the most common mistakes people make when emotions take over. Below are a few examples of what can go wrong. This information is for general education, not personal financial advice.

Selling at the bottom: You never know when the market will hit its lowest point and begin recovering. If you time the sale of your investments wrong, you’ll miss out on the recovery.

Locking in your losses: If you’re no longer invested, you can’t benefit if the market recovers.

Buying at a more expensive price: Often, investors who panic sell will wait until they’re “sure” the market has recovered before rebuying their investments. They typically do so at a much higher price than what they sold them for.

Losing out on compounding growth: If your money is on the sidelines (for example, in a cash or basic savings account), you might miss out on dividends and the compounding that can happen even during a market downturn.

Tax consequences: Selling can create taxable events, such as capital gains taxes if you sell at a profit. Depending on the account type, there may also be early-withdrawal penalties or other rules. These tax outcomes aren’t unique to panic selling, but you could overlook them if you’re hurrying to sell, so check the rules for your account type before you do.

How to avoid panic selling

Although it can be hard to avoid getting swept up in the emotions that occur during heavy market swings, you can prepare yourself beforehand by taking a few steps:

Know your goals: Match your investment strategy to your long-term goals. When your goals stay consistent, keeping your plan steady can help you avoid emotional, short-term decisions.

Align with yourrisk tolerance: If you’re more conservative by nature, choose an investment mix that feels comfortable for you. When your risk level matches your comfort level, you’re less likely to react emotionally during market ups and downs.

Build an emergency fund: If you already have cash set aside for emergencies, you’re less likely to need to sell your long-term investments when something goes wrong.

Take a time out: Pause before making any decisions after a market drop, and evaluate the situation before making a rash decision.

Remember history: Markets are always going up or down. While nobody can predict the future, knowing that markets have recovered from downturns many times may alleviate some of the short-term feelings of stress.

Diversify: Ensuring that all your investment eggs aren’t in one basket can help reduce your risk and the likelihood you’ll feel the need to sell in a panic.

Knowing when to sell

While panic selling can lead to mistakes, that doesn’t mean you should never sell. When you have an investment plan based on your goals, understand your risk tolerance, and know which investments you hold, you’re more likely to recognize when to hold or sell as things change over time.

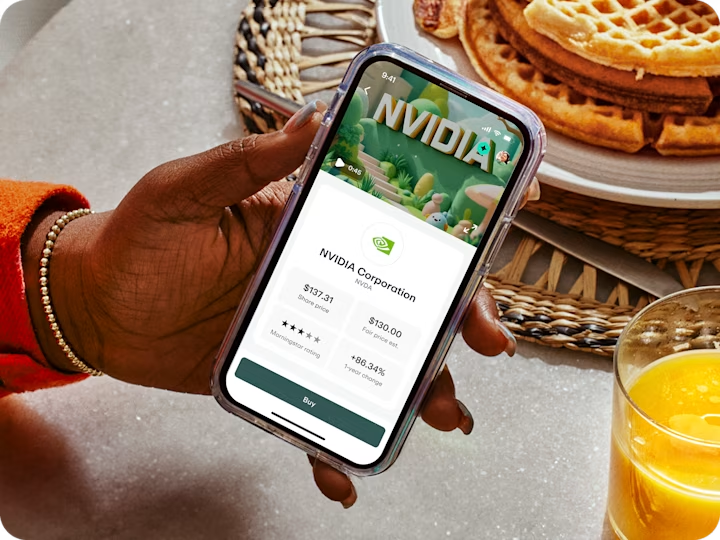

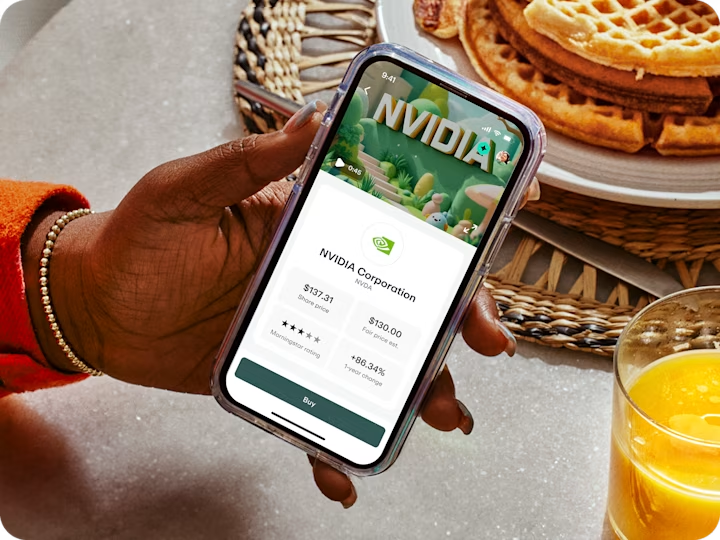

Investing is for kids, too. With Greenlight, kids can learn to invest with parental approval on every trade. Build their financial confidence! Try Greenlight, one month, risk-free.†

By: Brad Goldbach

Brad Goldbach is a writer focused on financial education, parenting, and tech. He brings over five years of journalism experience and a 12-year background in finance, including time as an advisor. At Greenlight, he’s written extensively on topics like investing for kids, credit building, and family budgeting. Married and a girl dad of two, Brad spends his free time reading, playing board games, and heading out on family hiking adventures when it’s not too hot in the Florida sun.

Share via