Using your kids’ debit cards to talk about money this summer

Hey, $mart parents 💡

Bring money lessons home with Greenlight’s $mart Parent newsletter, a quick read with impactful tips — delivered free to your inbox weekly.

The money talk — not as scary as the birds and bees, but still a big deal. In fact, 49% of parents say they’re not sure how to explain money to their kids [1]. Enter: Summer Break. More time at home means more time to talk about money management. Follow along for some conversation starters and tips on how to have the money talk.

EXPLAIN WHY BUDGETING IS IMPORTANT

79% of Americans keep a budget [2], which is great. Budgets may be a bit more involved for grownups, but that doesn’t mean your kids can’t start learning the basics. How? Start off by explaining why budgeting matters. There’s a good chance they’re already wondering that.

Conversation Starter: “What’s something you really want but you haven’t had the money to buy?” Maybe it’s something you can’t fit into your parent budget, or maybe it’s something you think they should buy on their own. During the summer, there are lots of opportunities for your kids to make money — help them figure out how to manage their earnings.

BREAK DOWN COMMON BUDGETING TERMS

Fixed expenses and variable expenses — ring a bell? Maybe, maybe not. Either way, these are important words to teach your kids about budgeting. Break it down into Summer Break terms and they’ll get it.

Conversation Starter: “A fixed expense is one that doesn’t change. Like, our Netflix subscription. It’s the same price every month. A variable expense is one that does change. Like, a meal at a restaurant. It can go up or down, depending on where we eat.”

TALK ABOUT SAVING MONEY

Budgeting for Summer Break is one thing — saving for it is another. Instead of handing over a wad of cash and hoping they stash it away, make it a hands-on experience with a bit of fun along the way.

Conversation Starter: “Saving money lets you buy things that you might not have enough money for right now. When you add a little bit of money to your savings over time, it adds up so you can buy those things one day.” Tip: Help your kids make a savings goal (or better, lots of goals). Then, work together to plan out how they’ll reach that goal.

GIVE KIDS THEIR OWN DEBIT CARD

The fun part about the money talk is giving your kids their own debit card. Unlike a credit card, they can only spend what’s on it. The best part? They won’t realize that they’re learning valuable lessons every time they use their card — but trust us, they are.

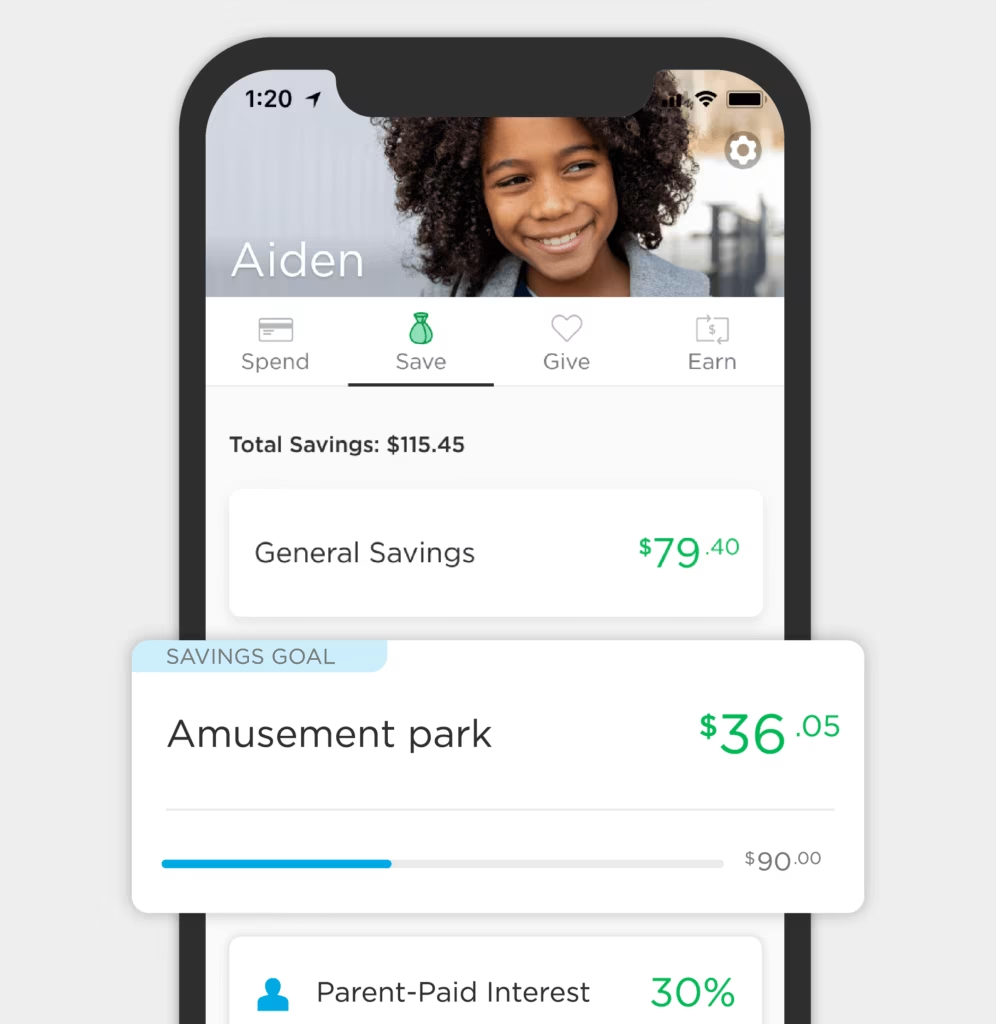

With the Greenlight debit card and app, your kids can:

Set savings goals.

Learn to make trade-off decisions. Keychain or shark-tooth necklace? It’s their call.

Earn allowance through chores. Cool fact: Greenlight kids who earn allowance save 26% more. Woohoo!

A few other things you can do in your app:

Manage access to ATMs. Are they withdrawing a bit too much? Set limits.

Choose stores. You decide where they can and can’t spend. Gas only? Just at restaurants? Adjust the settings in your app.

Get real-time notifications and monitor their spend levels.

GET SET FOR SUMMER

Join Greenlight today and help your kids get a head start on budgeting for their Summer Break — and for life! Sign up now

[1] Investopedia.com [2] Debt.com

Share via