5 ways kids and teens can save more money with Greenlight

Hey, $mart parents 💡

Bring money lessons home with Greenlight’s $mart Parent newsletter, a quick read with impactful tips — delivered free to your inbox weekly.

If you’re proud of your kids for saving their money, join the club. We’re so proud that we’ve introduced new ways for them to save even more with our two latest Savings Boosts: 1% Cash Back to Savings and 3% Greenlight Savings Reward.* Read on to hear all about how it works and other ways to save big with Greenlight.

P.S., you won’t see this in your app right away. Don’t worry — your Savings Boosts will be updated before the first payout in September.

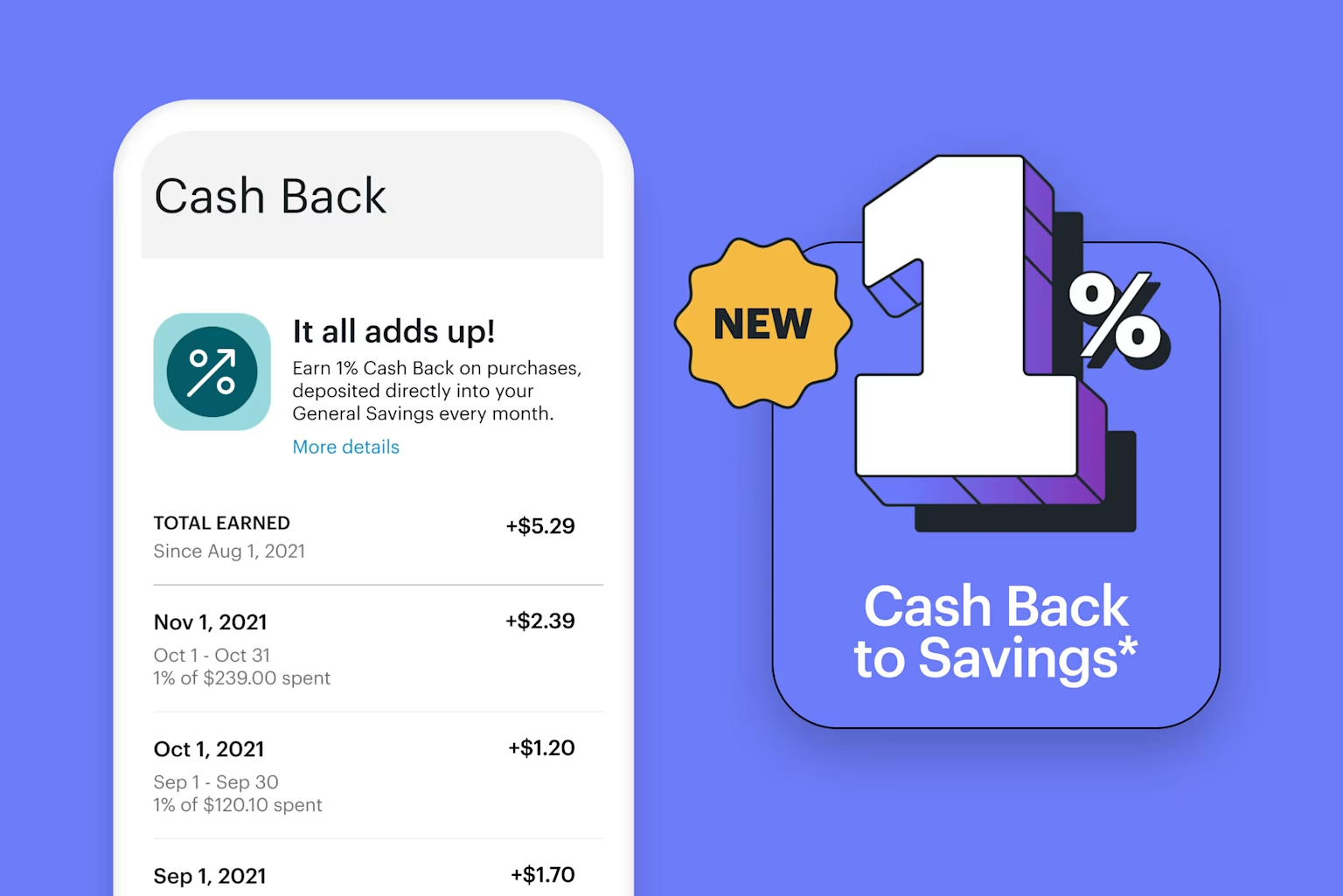

Cash Back to Savings

Not all cards give you cash back when you spend. Which is why we’re thrilled to share that Greenlight Max kids get 1% on every purchase — deposited into their Savings. This can serve as a lesson in choosing cards that reward you with incentives, so your money works harder for you.

To earn 1% cash back, switch to Greenlight Max or Greenlight Infinity and connect a bank account as your funding source.*

Greenlight Savings Reward

With Greenlight Savings Reward, kids earn up to 5% on Savings. It’s automatic, so they’re rewarded for their hard work and encouraged to keep it up. Your kids will see compounding interest in action, inviting teachable moments about smart money management and why it pays to save.

Parent-Paid Interest

Sometimes kids just need an extra boost from you. Enter Parent-Paid Interest. Parent-Paid Interest allows parents to incentivize their kids to save by paying interest on their kids' Savings at a rate of their choice.

Did you know the average set by Greenlight parents is 18%?

Why set a higher rate? They’ll quickly see their Savings grow, which encourages them to keep up the good work. They’ll thank you one day. We’re sure of it.

Round Ups

With Round Ups, kids round up purchases to the next dollar and add the change to their Savings.

It may sound small, but let’s talk about how cents add up. *Grabs calculator.* If your child pays $4.30 for a smoothie, 70 cents automatically goes to Savings. 10 smoothies later and they’ve already saved 7 bucks. Boom. Savings supercharged.

Savings Goals

Dreams need action plans. That’s why Greenlight kids set Savings Goals big and small — everything from AirPods and roller skates to a first car and college.

With our new Savings Boosts (Greenlight Savings Reward and Cash Back), your kids earn a little extra money to put toward those goals. Every bit counts.

Get the most out of Greenlight

What’s next? First, take a bow — you’re raising financially-smart kids. Then, keep it up by empowering them to become investors. Upgrade to and peruse our handy guide to investing to get the roadmap on how to shine a light on the world of investing for your kids and teens.

Still have questions about Cash Back and Greenlight Savings Reward? Find your answers here.

*Greenlight Core families can earn 2% per annum, Greenlight Max families can earn 3% per annum, Greenlight Infinity families can earn 5% per annum, and Greenlight Family Shield families can earn 6% per annum on an average daily savings balance of up to $5,000 per family. To qualify, the Primary Account must be in Good Standing and have a verified ACH funding account. See Greenlight Terms of Service for details. Subject to change at any time. **Greenlight Max, Infinity, and Family Shield families can earn 1% cash back on spending monthly. To qualify, the Primary Account must be in Good Standing and have a verified ACH funding account. See Greenlight Terms of Service for details. Subject to change at any time. ***Requires mobile data or a WiFi connection, and access to sensory and motion data from cell phone to utilize safety features including family location sharing and driving alerts and reports. Messaging and data rates and other terms may apply.

Share via