Why choose Greenlight over Venmo for teens?

Learn how we collect and use your information by visiting our Privacy Statement.

★ 4.8

App Store rating: 440k+ reviews

6.5M

Parents & kids loving Greenlight

$75M+

Invested by all Greenlight families

$700M+

Saved by Greenlight families to date

Greenlight vs. Venmo | Greenlight | Venmo for teens |

|---|---|---|

Debit card eligibility | All ages | Ages 13-17 |

Real-time spend alerts | ||

Receive money from friends & family | via Greenlight pay link: debit or credit card, Venmo, Apple Pay, or Google Pay | via Venmo |

Flexible parental controls & approvals | ||

Up to 5% on savings¹ | ||

Up to 1% cash back² | ||

Custom debit card | ||

Allowance & chores | ||

Investing for Teens³ | ||

Family location sharing & SOS alerts⁴ | ||

Driving reports, alerts, & crash detection⁴ |

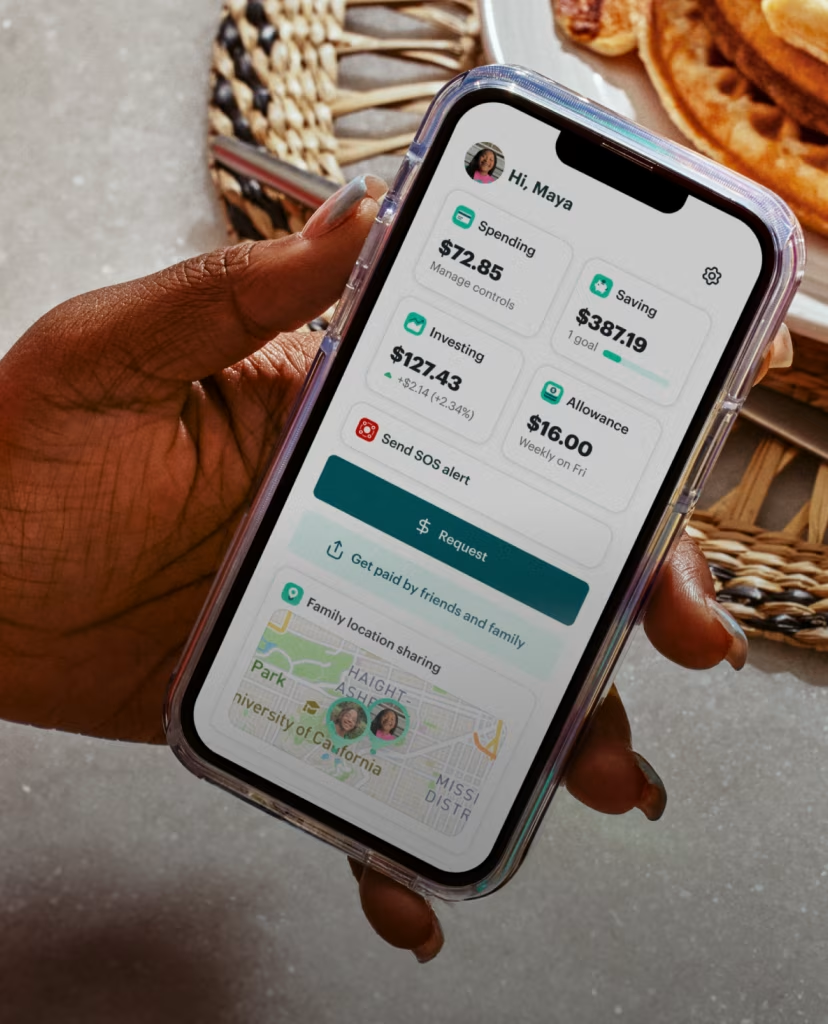

Best-in-class money management for teens.

Greenlight and Venmo give teens a debit card of their own for everyday spending. But with Greenlight, teens can do so much more.

They earn money through chores, get up to 5% on savings¹, and build healthy financial habits. Parents set spend controls, approve payments, and transfer money instantly from their Parent’s Wallet for free.

Join Greenlight. Love it or it's on us.†

Plans start at just $5.99/month for the whole family. Includes up to five kids.

Read how we use and collect your information by visiting our Privacy Statement.