BusyKid vs. Greenlight: Choosing the best all-in-one app for families

Learn how we collect and use your information by visiting our Privacy Statement.

Teaching your kids financial literacy has never been easier with digital money management tools, where you can set chores and allowances track savings goals, and even teach your kids how to invest from an early age. Here, we’re taking a look at the differences between BusyKid vs. Greenlight, two types of debit cards for kids that parents can choose from to help teach their kids money basics and beyond.

Features comparison

When making a decision between BusyKid vs. Greenlight, you’ll want to consider each app’s features. Both of these digital money management apps come with standard features like a debit card for kids, allowance and chore tracking, and investment features. But signing up for Greenlight gives you access to more features beyond the basics, like granular parental spending controls, custom photo cards, family location sharing³, SOS alerts, and drive reports, making Greenlight an all-in-one app for families.

Greenlight vs. BusyKid | Greenlight | BusyKid |

|---|---|---|

Pricing | Starts at $5.99 / month for up to 5 children | $48/year, billed annually |

Debit card for kids | ||

Allowance & chores | ||

Investing for Kids | ||

Category-specific parental controls | ||

Upload your own custom card photo | ||

Up to 5% on savings¹ | ||

Up to 1% cash back² | ||

Family location sharing and SOS alerts³ | ||

Driving reports, alerts, and crash detection³ |

BusyKid at a glance

BusyKid is a money management system for kids and teenagers, ages 5 through 17. It includes features like chores and allowances, investing, and parental savings matching. You can receive up to five pre-paid BusyKid debit cards per family, and there are 10 designs to choose from to customize your cards. BusyKid’s debit cards are backed by Visa, so there are built-in security features like the ability to lock the card if it’s lost or misplaced. Beyond learning how to save, spend, and invest, kids can also choose to support one of the 50 charities partnered with BusyKid, like the American Red Cross and Toys for Tots.

BusyKid features

Debit card for kids, age 5 through 17

Chore chart and tracking, set by age

Allowance management, set by age

Investing for kids

Charity donation options

Bonus payout

Parental matching on child savings

Parental money control, approval, and activity monitoring

BusyPay money sending

Greenlight at a glance

Greenlight is a debit card for kids and money management app that helps parents build good financial habits for their kids by teaching them how to earn, spend, and save wisely. With Greenlight, you can take advantage of three different plans: Core, Max, and Infinity. All of these plans include core features like custom debit cards for up to five kids, chores and allowance tracking, cash back on savings¹, and investing features. If you choose to upgrade to the Greenlight Max or Greenlight Infinity plans, you can take advantage of additional features like up to 1% cash back on purchases², identity theft, purchase and phone4 protections, family location sharing³, crash detection, driving reports, and more.

Greenlight features

Debit card for kids

Chore and allowance management

Investing for kids and parents

Category-specific parental spend controls

Up to 1% cash back²

Up to 5% on savings¹

Financial literacy games

Family safety features like location sharing, crash detection, SOS alerts, and driving reports³

Quickly send money

Identity theft, phone4, and purchase protection

With a debit card of their own, kids and teens learn to spend wisely, keep an eye on balances, and track their spending. Big money dreams? Set savings goals and start investing with as little as $1 — with your approval on every trade.

Pricing

Pricing for BusyKid vs. Greenlight is pretty comparable at the base level, though BusyKid only offers one plan tier while Greenlight offers three.

BusyKid pricing

$48 per year, billed annually

Greenlight pricing

Greenlight Core: $5.99 per month

Greenlight Max: $10.98 per month

Greenlight Infinity: $15.98 per month

Parental controls

Both BusyKid and Greenlight offer parental controls with their respective apps, but you’ll find more robust parental features with Greenlight. Here’s how they compare.

BusyKid parental controls

Parental money movement controls

Transaction activity monitoring

Greenlight parental controls

Store-level parental controls

Category-specific parental controls

Flexible spending limits and real-time notifications

Parental approval for money sent via Greenlight Pay Link

Investing features

When it comes to learning about investing, Greenlight and BusyKid offer tools to help both kids and parents level up their investing know-how. Here’s how they stack up against each other in those areas.

BusyKid investing

With BusyKid, kids can learn to invest in hundreds of different stocks and EFTs with as little as $10 (there are about 4,000 companies and EFTs available to choose from). There are also no commissions to buy or sell stocks.

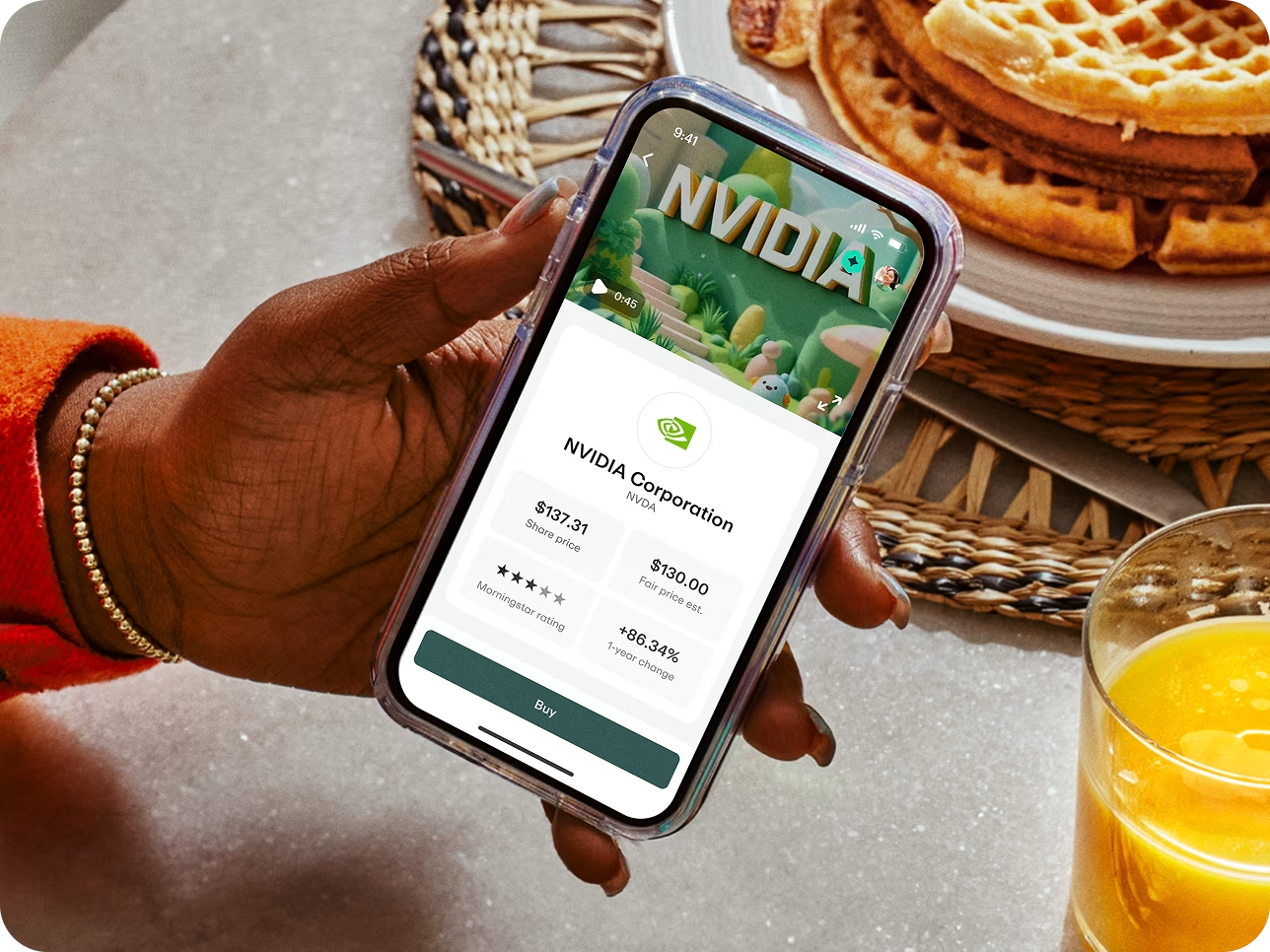

Greenlight investing

Greenlight offers an Invest for Parents tool in the Greenlight Core plan, where parents can choose from 10 selected EFTs and start investing with as little as $1, with no hidden trading fees. In the Greenlight Max and Infinity plans, kids can get in on the action with Investing for Kids — a platform where kids learn to invest and parents approve every trade. Kids can research their favorite stocks and EFTs and buy shares with as little or as much as they’re comfortable with — once parents give the OK, of course.

When kids start investing early, they have the chance to grow their money as they save toward all their future goals. New car. College education. First apartment. You name it.

Educational features

Managing money in real-time is just one component to learning smart financial basics — educational features like games and in-app content can help further financial literacy. Here’s how BusyKid and Greenlight educate kids and families about money.

BusyKid educational features

BusyKid’s core educational component is a partnership with MoneyTime, an online financial literacy program aimed at kids aged 10 to 14. With MoneyTime, kids can learn from lessons and quizzes, plus play a money management game to really hone in on their personal finance knowledge. MoneyTime isn’t included when you purchase BusyKid though — there’s a special 25% off offer for BusyKid families to purchase and learn from MoneyTime.

Greenlight educational features

Greenlight Level Up™ is an in-app game where kids can build the foundations of financial literacy. It includes interactive challenges developed with a best-in-class educational curriculum by certified financial education experts. The game is included with all three of Greenlight’s plans, at no additional cost. Outside of the app, Greenlight also offers free financial education lesson plans for teachers as well as a dedicated blog, The Learning Center, where families can learn more about the basics of money management and personal finance.

BusyKid vs. Greenlight: Which one is right for your family?

When choosing a debit card for kids, it’s important to think about what’s right for your family’s unique needs. If you’re looking for a solid basic money management app that comes with the ability to learn about investing, BusyKid may be for you. But, if you’re looking for more features beyond the basics, like family location sharing³, crash detection, drive reports, and granular parental money controls in addition to money management and investing, Greenlight might work better for your family.

Both you and your kids download the Greenlight app — with tailored experiences. They check off chores, you automate allowance. They spend wisely, you set flexible controls. They build healthy financial habits, and you cheer them on.

FAQs

Join Greenlight. Love it or it's on us.†

Plans start at just $5.99/month for the whole family. Includes up to five kids.

Read how we use and collect your information by visiting our Privacy Statement.