Capital One Teen Checking vs. Greenlight: Which is best for teens?

Learn how we collect and use your information by visiting our Privacy Statement.

Parents have so many options today when it comes to checking accounts and debit cards that can help teach kids and teens better money habits. But sometimes, having so many options can make it challenging to figure out which option is best. Let’s compare Capital One Teen Checking vs. Greenlight and see how they stack up for teens so you can pick the best one for your family.

Features comparison

Both Greenlight and Capital One Teen Checking offer features that help parents teach their teens about financial independence, including teen debit cards, the ability to set savings goals, and parental account access. However, Greenlight also offers category-specific parental controls, investment options, chores management, and enhanced family safety features. Greenlight is a great choice for families who want a financial platform with robust features, while Capital One Teen Checking is better for families seeking a simple, no-fee account for their teens.

Greenlight vs. Capital One Teen Checking | Greenlight | Capital One Teen Checking |

|---|---|---|

Pricing | Starts at $5.99 / month for up to 5 children | No monthly service fees |

Debit card for teens | ||

Data sharing | Your child’s data is safe with Greenlight and not shared with anyone. | Credit card company has access to your child’s data. |

Category-specific parental controls | ||

Up to 5% on savings¹ | ||

Up to 1% cash back² | ||

Investing for Kids³ | ||

Custom debit card | ||

Chores management | ||

Family location sharing and SOS alerts⁴ | ||

Driving reports, alerts, and crash detection⁴ |

Capital One Teen Checking at a glance

Capital One Teen Checking is an online-only checking account for teens that's designed to teach them about money management. A parent or guardian jointly owns the checking account, and teens can access their account through the Capital One app, deposit checks, set savings goals, and make purchases with a debit card.

Features

Debit card for kids ages 8 and up

Access to Capital One’s mobile app for account management

Interest-earning on any balance amount

Teen savings goals

Parent allowance transfers

Parent account monitoring

Fraud protection

Greenlight at a glance

Greenlight is a money management app and debit card that helps parents guide their teens toward making smart financial decisions. It offers three flexible plans: Core, Max, and Infinity. All plans provide essential features like personalized debit cards for up to five kids, tools for tracking chores and allowance, savings rewards¹, and investing opportunities. Families who choose the Greenlight Max or Greenlight Infinity plans unlock extra benefits, including up to 1% cash back on purchases², identity theft protection, purchase and phone4 coverage, family location sharing³, crash detection, driving insights, and more.

Features

Debit card for teens

Data sharing protection

Category-specific parental controls

Up to 5% on savings¹

Up to 1% cash back²

Investing for kids and parents

Chores and allowance management

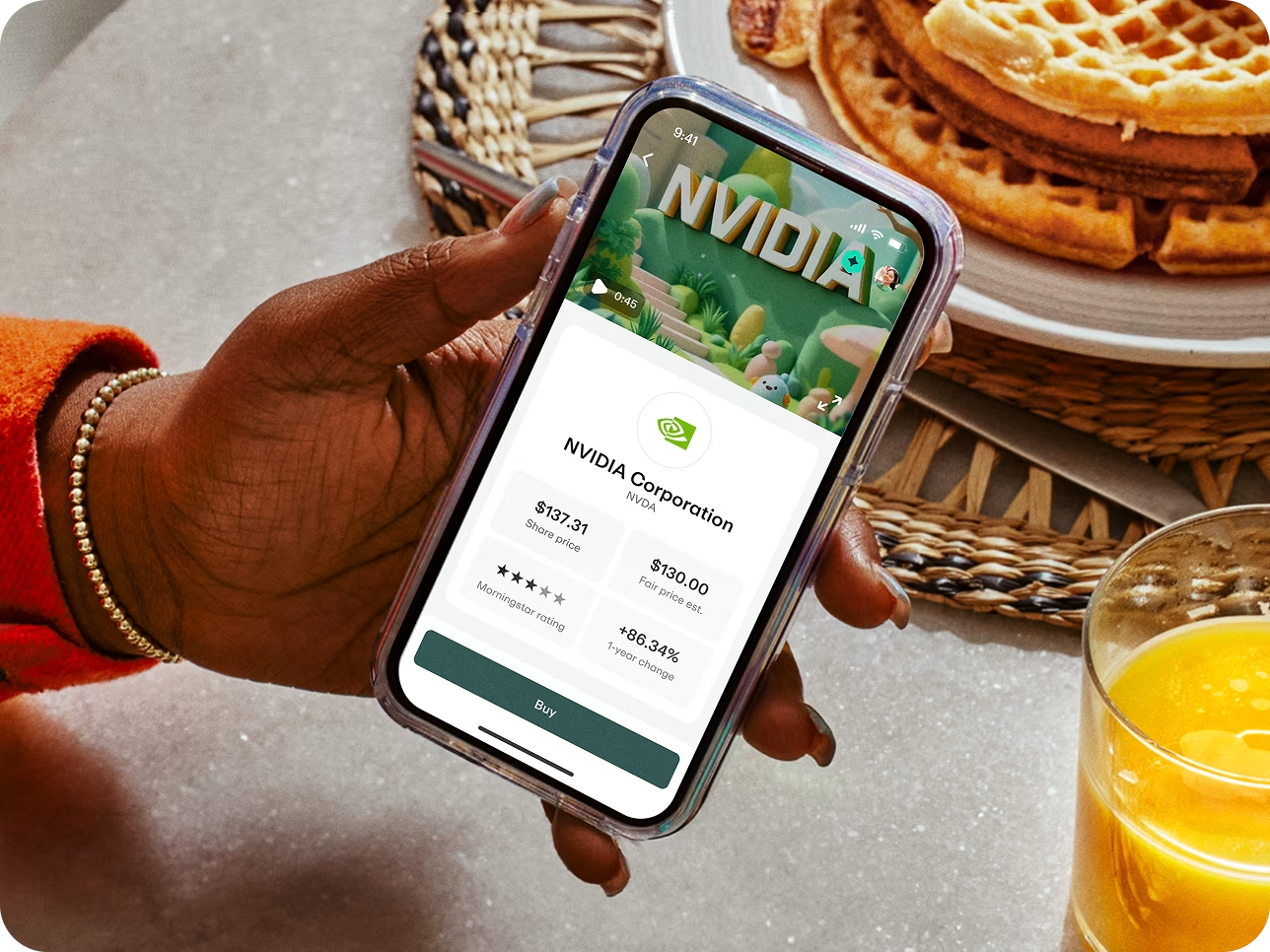

Financial literacy games

Family safety features like location sharing, crash detection, SOS alerts, and driving reports³

Quickly send money

Identity theft, phone4, and purchase protection

With a debit card of their own, kids and teens learn to spend wisely, keep an eye on balances, and track their spending. Big money dreams? Set savings goals and start investing with as little as $1 — with your approval on every trade.

Pricing

When you compare Capital One Teen Checking and Greenlight in terms of pricing, it’s important to consider what you’re getting for the cost. Capital One Teen Checking is completely free, making it a great choice for families who are simply looking for a basic bank account that allows teens to manage their money with minimal parental oversight. Greenlight, on the other hand, starts at $5.99/month and offers advanced features for families who want an all-in-one money management app. For example, Greenlight provides features like parental controls, chore tracking, savings goals, and real-time notifications as part of its Core plan, while the higher-tier plans include extras like up to 1% cash back², investing, driving insights³, and more.

Capital One Teen Checking pricing

No monthly fees

Greenlight pricing

Greenlight Core: $5.99 per month

Greenlight Max: $10.98 per month

Greenlight Infinity: $15.98 per month

Parental controls

Both the Capital One Teen Checking account and Greenlight give parents the ability to monitor account activity, but Greenlight offers more granular parental control features like store-level and category-specific controls. Here’s how they compare.

Capital One Teen Checking parental controls

Parental money movement controls

Transaction activity monitoring

Greenlight parental controls

Store-level parental controls

Category-specific parental controls

Flexible spending limits and real-time notifications

Parental approval for money sent via Greenlight Pay Link

Safety features

Safety is top-of-mind for every parent considering a debit card for their teen. When reviewing the safety features of Greenlight vs. Capital One Teen Checking, both prioritize security, while specific features differ significantly. Capital One Teen Checking provides essential security features, while Greenlight takes safety a step further with enhanced features designed to protect not just your teen’s money, but also their well-being.

Capital One Teen Checking safety features

Capital One Teen Checking includes security features like fraud protection, 24/7 account monitoring, and mobile alerts. However, it’s worth noting that, as a credit card company, Capital One has access to and may use your kid’s data, while Greenlight does not. For families with privacy concerns, this could be a consideration when choosing between options.

Greenlight safety features

Greenlight provides enhanced safety features, including:

Fraud protection from Mastercard®’s Zero Liability Protection Policy

Customer support 24/7

Identity theft, purchase, and phone protection4

Crash detection with 911 dispatch ³

SOS alerts³

Family location sharing ³

Driving reports and real-time trip alerts ³

Investing features

If teaching your teen about investing is a priority, Greenlight is the better option. Capital One Teen Checking doesn’t offer any investing options, however Greenlight includes tools that allow teens to learn the basics of investing hands-on.

The Greenlight Core plan includes the Invest for Parents feature, which allows parents to invest in a curated selection of 10 ETFs with no hidden fees and a low starting amount of just $1. For families that upgrade to Greenlight Max or Infinity, kids and teens can dive into Investing for Kids — a hands-on platform where teens can research stocks and EFTs, explore investment opportunities, and make trades, all with parental approval. This combination of learning and oversight empowers teens to build their investing knowledge while parents maintain control over the process.

When kids start investing early, they have the chance to grow their money as they save toward all their future goals. New car. College education. First apartment. You name it.

Educational features

Providing access to an account is only one part of teaching teens about financial literacy. While Capital One offers basic tools that focus on teen money management, Greenlight stands out with an in-depth curriculum designed for children of all ages. Here’s how Greenlight and Capital One Teen Checking measure up when it comes to educational content.

Capital One Teen Checking educational features

Capital One Teen Checking has in-app features that can help teach teens about money management, including savings goals and spending limits.

Greenlight educational features

With Greenlight Level Up™, an engaging in-app game, teens can develop essential financial literacy skills through interactive challenges created by certified financial education experts. This educational tool is available across all three of Greenlight’s plans at no extra cost. Greenlight also supports financial learning with free financial education lesson plans for school teachers and a dedicated blog, The Learning Center, offering practical tips and insights for families to better understand money management and personal finance.

Greenlight vs. Capital One Teen Checking: Which one is right for your family?

Capital One Teen Checking and Greenlight both have their unique strengths, but determining which one is better depends on your family’s needs. For families looking for a simple, no-cost checking account, Capital One Teen Checking may be a good fit. However, if you value advanced features like financial education opportunities, investing tools, robust safety features, and parental controls, Greenlight may be the better option. Ultimately, Capital One Teen Checking is a basic checking account, while Greenlight is an all-in-one money management and safety app tailored specifically for families.

FAQs

Join Greenlight. Love it or it's on us.†

Plans start at just $5.99/month for the whole family. Includes up to five kids.

Read how we use and collect your information by visiting our Privacy Statement.