FamZoo vs. Greenlight: Choosing the best app for your family

Learn how we collect and use your information by visiting our Privacy Statement.

When it comes time to begin teaching your kids how to spend and save their money wisely, many families turn to digital money management tools to make the learning process easy. With these tools, families can often assign chores and pay allowances, set savings goals, and even get a head start on learning to invest money. Here, we’re looking at the differences between FamZoo vs. Greenlight, two types of debit cards for kids that help families teach the fundamentals of money management.

Features comparison

Greenlight vs. FamZoo | Greenlight | FamZoo |

|---|---|---|

Pricing | Starts at $5.99 / month for up to 5 children | $5.99/month or $59.90 paid annually |

Debit card for kids | ||

Allowance & chores | ||

Investing for kids | ||

Category-specific parental controls | ||

Upload your own custom card photo | ||

Up to 5% on savings¹ | ||

Up to 1% cash back² | ||

Family location sharing and SOS alerts³ | ||

Driving reports, alerts, and crash detection³ |

FamZoo at a glance

FamZoo is a money management system for kids beginning in preschool all the way through college. FamZoo’s prepaid debit cards include a parent-loading card alongside cards for your kids and IOU accounts that track money parents are holding somewhere else. FamZoo never links directly to a parent bank account — the parent-loading card can be reloaded using direct deposit, bank transfer, cash at a participating retailer, or digital wallet transfers from services like ApplePay or PayPal before being disbursed to other family members’ prepaid cards. Kids and teens can keep track of their chores, earning chore rewards if they complete them or a penalty if they don’t. Parents can also set up automatic allowance transfers to their child’s card. FamZoo includes a family billing system, allowing parents to “charge” kids for shared expenses like cell phone bills, and informal loan tracking where parents can track money loaned to their kids at a parent-defined loan interest rate.

FamZoo Features

Debit card for kids

Chore and allowance checklist

Spend, save, give accounts

Scheduled and instant transfers

Payment splits

Real-time activity alerts

Parent-paid interest

Family billing

Informal loan repayment tracking

Greenlight at a glance

Greenlight is a debit card for kids and a money management app that helps parents build good financial habits for their kids by teaching them how to earn, spend, and save wisely. Greenlight’s three plans (Core, Max, and Infinity) include core features like custom debit cards for up to five kids, chores and allowance tracking, cash back on savings¹, and investing features. If you’re looking for more robust features, then you can upgrade to the Greenlight Max or Greenlight Infinity plans. With these plans, you and your kids can take advantage of additional features like up to 1% cash back on purchases², identity theft, purchase and phone⁴ protections, family location sharing³, crash detection, driving reports, and more.

Greenlight Features

Debit card for kids

Chore and allowance management

Investing for kids and parents

Category-specific parental spend controls

Up to 1% cash back²

Up to 5% on savings¹

Parent-paid interest

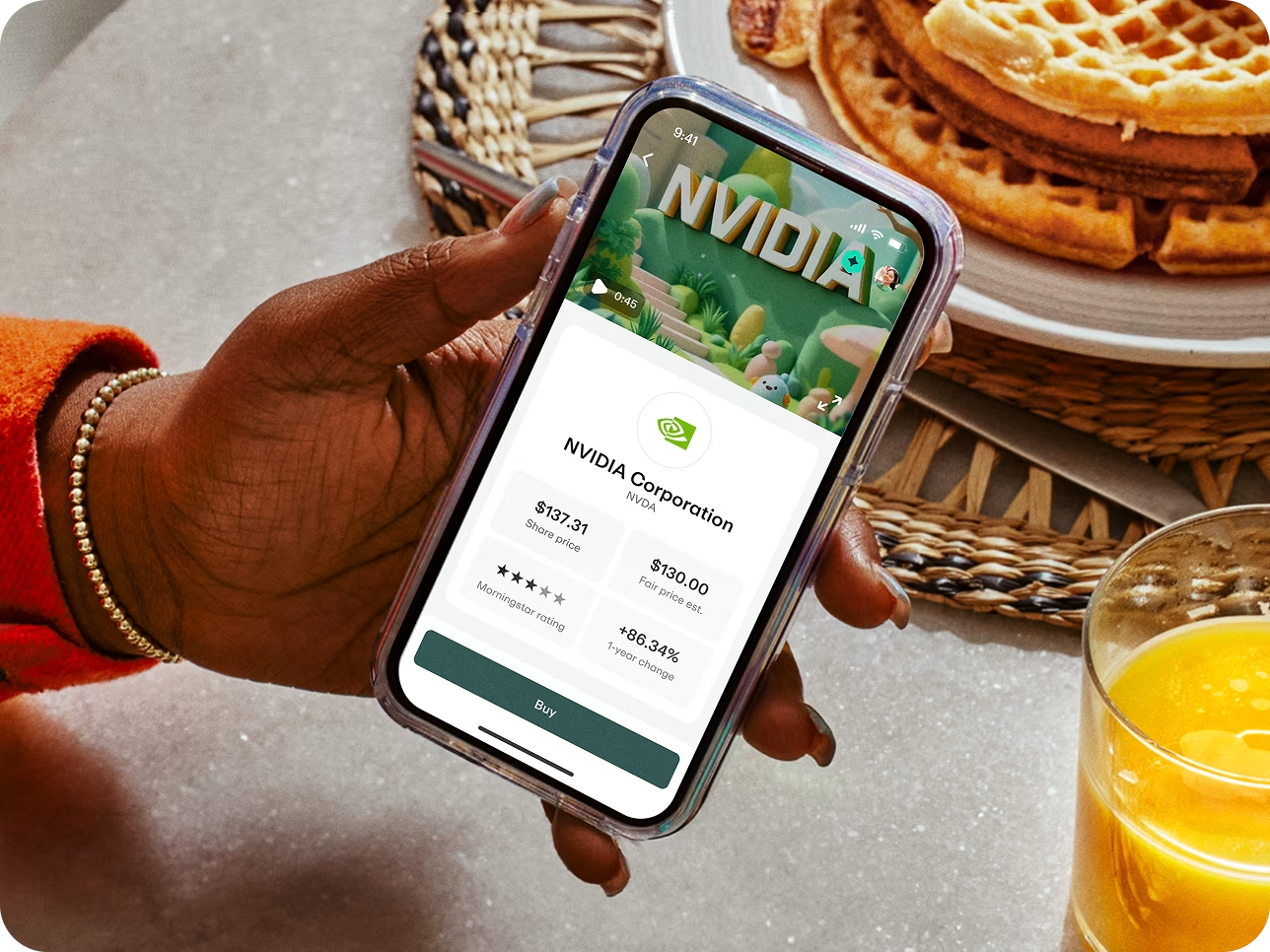

Financial literacy games, like Greenlight Level Up™

Family safety features like location sharing, crash detection, SOS alerts, and driving reports³

Quickly send money

Identity theft, phone⁴, and purchase protection

With a debit card of their own, kids and teens learn to spend wisely, keep an eye on balances, and track their spending. Big money dreams? Set savings goals and start investing with as little as $1 — with your approval on every trade.

Pricing

FamZoo and Greenlight both start at $5.99 per month. With FamZoo, you have the option of pre-paying in advance, which brings the monthly price down a bit, while Greenlight offers three plan tiers with three different price points.

FamZoo only offers one standard plan, however, that has basic money management tools and no financial literacy gaming component. But, with Greenlight’s Core plan, which costs the same $5.99 a month as FamZoo, you’re able to access features where kids can earn 2% on savings¹ and play Level UpTM, Greenlight’s in-app financial literacy game developed with a best-in-class educational curriculum by certified financial education experts.

FamZoo pricing

Monthly: $5.99

Yearly: $59.90

Greenlight pricing

Greenlight Core: $5.99 per month

Greenlight Max: $10.98 per month

Greenlight Infinity: $15.98 per month

Parental controls

Both FamZoo and Greenlight offer parental controls with their respective apps, but you’ll find more robust parental features with Greenlight. Here’s how they compare.

FamZoo parental controls

Parent-controlled accounts

Real-time spending activity alerts

Parental approval for money requests

Parental ability to lock and unlock cards

Greenlight parental controls

Store-level parental controls

Category-specific parental controls

Flexible spending limits and real-time notifications

Parental approval for money sent via Greenlight Pay Link

Investing features

When it comes to investing, only Greenlight offers parents the ability to teach their kids how to invest wisely. Families that use FamZoo have to sign up for a different service if they want to teach their kids investing skills. Greenlight offers an Invest for Parents tool in the Greenlight Core plan, where parents can choose from 10 selected EFTs and start investing with as little as $1, with no hidden trading fees. In the Greenlight Max and Infinity plans, kids can start their investing journey with Investing for Kids — a platform where kids learn to invest and parents approve every trade.

When kids start investing early, they have the chance to grow their money as they save toward all their future goals. New car. College education. First apartment. You name it.

Savings features

It’s important to learn how to spend money thoughtfully, but it’s also important to learn how to save money, too. Both FamZoo and Greenlight offer kids the opportunity to save their earnings — here’s how they stack up.

FamZoo savings features

With FamZoo, kids can set up a spend account, a savings account, and a giving account to allocate money for charitable giving. Parents also have the option to set up Parent-Paid Interest on their child’s savings accounts, where they can decide the interest rate, the compound frequency, and the desired start date. Savings goals are easy to set up as well — kids can easily set, track, and work to achieve their own financial goals this way.

Greenlight savings features

With Greenlight, you can encourage kids to grow their money and watch them reach their savings goals faster. Kids can earn up to 5% on savings¹, round up purchases and send spare change to savings, and take advantage of Parent-Paid Interest, where you can pay interest at a rate you decide. Kids and teens can also set up Greenlight Savings Goals to allocate money specifically to a goal — like a new bike or game. Before kids can spend money from either their savings account or Greenlight Savings Goal, they have to make a request to a parent account to have money moved into their spend account, ensuring important conversations about spending hard-earned money or continuing to save.

FamZoo vs. Greenlight: Which one is right for your family?

When deciding which debit card for kids to use, think about what makes the most sense for your family. If you’re looking for basic money management alongside tools like family billing and loan repayment, then FamZoo is a solid option. But, if you’re looking for more robust features like investment tools, family location sharing³, crash detection, drive reports, and granular parental money controls in addition to money management, Greenlight might work better for your family.

Both you and your kids download the Greenlight app — with tailored experiences. They check off chores, you automate allowance. They spend wisely, you set flexible controls. They build healthy financial habits, and you cheer them on.

FAQs

Join Greenlight. Love it or it's on us.†

Plans start at just $5.99/month for the whole family. Includes up to five kids.

Read how we use and collect your information by visiting our Privacy Statement.