Trading vs. investing: A simple guide for families and kids

Hey, $mart parents 💡

Bring money lessons home with Greenlight’s $mart Parent newsletter, a quick read with impactful tips — delivered free to your inbox weekly.

Your child buys their first stock. You’re excited, they’ve made their first investment! But then, you realize they’re checking it every day and want to sell it for a new investment as soon as its price goes up slightly. Then, they continue repeating the process.

This mindset is what’s known as trading, which has a very different approach than investing. While both can be valid ways to approach stocks, it’s important to know the difference, so you can manage your money in the best possible way for your personal goals.

What is investing?

Investing is when you put money into assets, like stocks or ETFs, for long-term growth. The goal is to let compounding work over time to grow your wealth steadily. Investors typically take a “buy and hold” approach, looking at investments in years, rather than days. Investors are patient and focused on a consistent path to accomplish their goals, rather than trying to make a quick profit.

What is trading?

In contrast, trading is when you buy and sell more frequently with the goal of profiting from short-term price changes. Trading comes in many forms, such as day trading (when someone buys and sells shares on the same day) or swing trading (buying and holding for a few days or weeks before selling).

Since it’s over a shorter period, trading requires you to pay much closer attention to price movements. It also typically involves more risk than long-term investing, since the market is more unpredictable in shorter timeframes. Many people find trading exciting, but it can also be stressful and lead to costly or emotional decisions.

The key differences between trading and investing

Aspect | Investing | Trading |

Time frame | Long term | Short term |

Risk | Lower with time | Higher in short bursts |

Effort | Occasional check-ins | Daily monitoring |

Mindset | Patient, steady | Fast-paced, reactive |

Goal | Grow wealth | Profit from movement |

Why investing can be a better starting point

When comparing the two, investing is typically a safer starting point for most families. Why?

It’s simpler, since it doesn’t require constant research and monitoring the changes in the markets every day.

Risks are lower, since you can take a more patient, steady approach to growing wealth over the long-term.

For beginners, it’s typically less stressful to plan ahead, minimizing the panic over short-term market swings while keeping the bigger picture at the forefront.

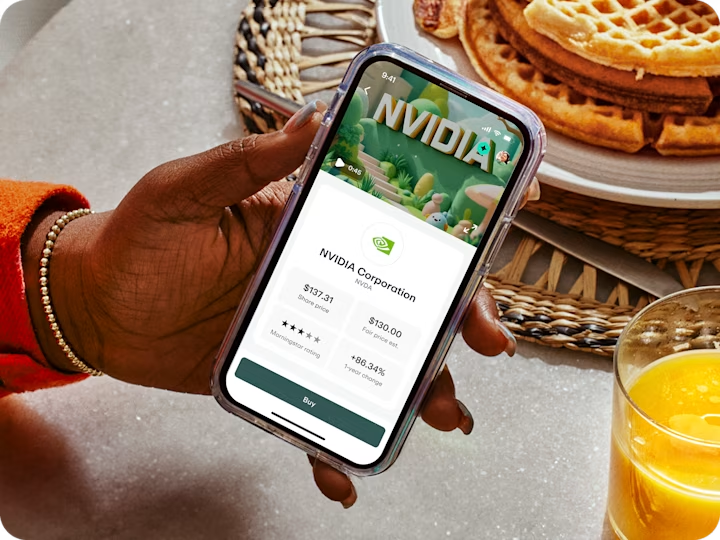

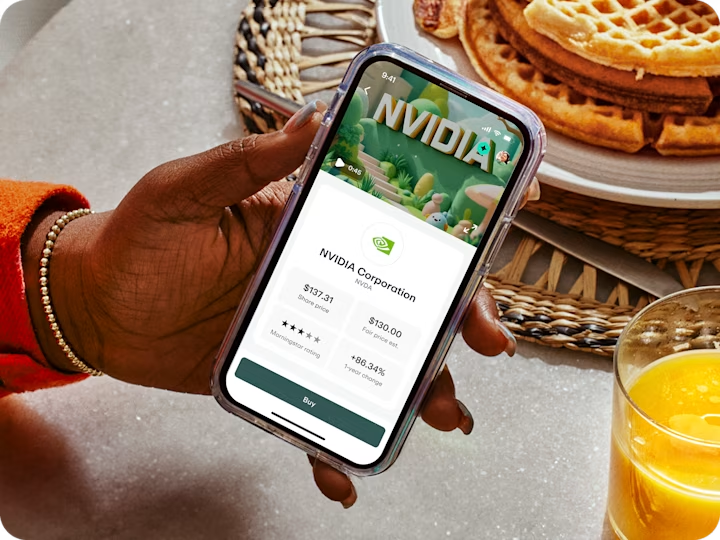

Investing with Greenlight

Greenlight’s debit card for kids and family investing app© gives kids the tools to learn how to grow their savings, research investments, and propose trades for parents to approve, giving families an opportunity to discuss and learn investing together.

Bonus: There’s no minimum; Kids can start with as little as $1 by purchasing fractional shares.

Common pitfalls to watch for

All investment strategies carry some inherent risk. Even with long-term investing, there are a few things to watch out for to increase your chances of success.

Overreacting to short-term drops: Even with a long-term approach, short-term price drops in your investments can stir negative emotions. Remember your long-term plan and avoid making emotional, short-term decisions when this happens.

Chasing trends: Even long-term investors can get caught up in chasing what’s “hot” today. Remember, these hot companies can cool off quickly. Make sure you’re investing with a long-term mindset rather than what’s popular now.

Lack of diversification: No one really knows what the future holds, so one of the better ways to prepare is to ensure you don’t put all your investing eggs in one basket. ETFs and index funds are a great way to naturally diversify your portfolio, and you can also do it with individual stocks.

Forgetting goals: Always review your goals to remind yourself why you started investing and what long-term plan you’re following. This can keep you on track, especially if you get discouraged or consider abandoning your plan.

Learning money lessons along the way

No matter which path you take, trading and investing both offer valuable financial lessons, including discipline and money management. Set your goals, develop a plan, and make adjustments along the way as you learn and grow.

Investing is for kids, too. With Greenlight, kids can learn to invest with parental approval on every trade. Build their financial confidence! Try Greenlight, one month, risk-free.†

By: Brad Goldbach

Brad Goldbach is a writer focused on financial education, parenting, and tech. He brings over five years of journalism experience and a 12-year background in finance, including time as an advisor. At Greenlight, he’s written extensively on topics like investing for kids, credit building, and family budgeting. Married and a girl dad of two, Brad spends his free time reading, playing board games, and heading out on family hiking adventures when it’s not too hot in the Florida sun.

© 2025 Greenlight Investment Advisors, LLC, an SEC Registered Investment Advisor provides investment advisory services to its clients. Investing involves risk and may include the loss of principal. Investments are not FDIC-insured, are not a deposit, and may lose value.

Share via