Top 10 Greenlight debit card alternatives for kids and teens

Learn how we collect and use your information by visiting our Privacy Statement.

Greenlight is an award-winning, all-in-one money app and debit card for kids and teens. Its innovative platform helps parents teach money management safely, with parental spend controls, purchase approvals, and automated chores and allowance tools. Kids learn to earn and save with savings rewards¹, fun games, and a cool investing for kids³ feature.

The family debit card space is crowded, though, with many companies offering similar basics. So which one's right for your family? Here's a quick look at the details, prices, pros, and cons of some of the top Greenlight card alternatives for teens and kids to help you make an informed decision.

Greenlight card alternatives at a glance

Acorns Early (formerly GoHenry)

BusyKid

Capital One

Famzoo

Venmo for teens

Modak Makers

Till

Step

Current

Bank of America SafeBalance® for Family Banking

1. Acorns Early (formerly GoHenry)

Monthly fee

$5/mo. for one child

$10/mo. for 2 to 4 kids

Features

Debit card for kids 6 to 18

Chores and allowance tool, customizable by age

Parent-paid interest

Parental money controls

Comprehensive financial literacy library

Highlights

Acorns Early offers core features like a debit card, allowance automation, chore assignments, and basic parental controls. It's popular with many families for its comprehensive financial literacy section and a large menu of personalized card options.

Priced only $1 apart, Greenlight and Acorns Early each include the debit card, allowance, and chores tools. But Acorns Early doesn't offer the savings incentives¹ or cash back² that Greenlight does – which can help grow more wealth over time.

Acorns Early also lacks enhanced safety options, so it's less flexible if your needs change. With Greenlight, you can upgrade to benefits like location sharing, SOS alerts, crash detection, and driving reports4. You always have the option to upgrade (or downgrade) to fit your priorities.

With a debit card of their own, kids and teens learn to spend wisely, keep an eye on balances, and track their spending. Big money dreams? Set savings goals and start investing with as little as $1 — with your approval on every trade.

2. BusyKid

Monthly fee

$48 per year, billed annually

Features

Debit card for kids 5 to 17

Chore chart and tracking, set by age

Allowance management, set by age

Investing for kids

Charity donation options

Bonus payout

Parental matching on child savings

Parental money control, approval, and activity monitoring

BusyPay money sending

Highlights

BusyKid offers a prepaid Visa debit card through its money management app, which includes automated chores and allowance, savings and parental matching, and investment tools.

Both digital money management apps come with standard features like a debit card for kids, allowance and chore tracking, and investing basics. But signing up for Greenlight gives you access to more features beyond the basics, like granular parental spending controls, custom photo cards, family location sharing, SOS alerts, and drive reports4, making Greenlight an all-in-one app for families.

For a basic money management app that includes investing for kids, BusyKid may fit the bill. But if you want more features and flexibility, like family location sharing, crash detection, drive reports4, and granular parental money controls in addition to money management and investing³, Greenlight might work better for your family.

3. Capital One Teen Checking

Monthly fee

None

Features

Debit card for kids ages 8 and up

Access to Capital One's mobile app for account management

Interest-earning on any balance amount

Teen savings goals

Parent allowance transfers

Parent account monitoring

Fraud protection

Highlights

With Capital One's free, online-only checking account for teens, a parent or guardian jointly owns the checking account, and teens access their accounts through the Capital One app. You can deposit checks, set savings goals, and make purchases with a debit card.

While there are no monthly service fees, CapitalOne can access kids' data, and the app lacks more robust safety, investing, and financial literacy tools.

Ultimately, Capital One Teen Checking is a basic checking account. Greenlight is an all-in-one money management and safety app tailored specifically for families.

Capital One Teen Checking may work for families seeking a simple, no-fee account for their teens. However, if you value advanced features like financial education opportunities, investing tools³, robust safety features, and parental controls, Greenlight may be the better option.

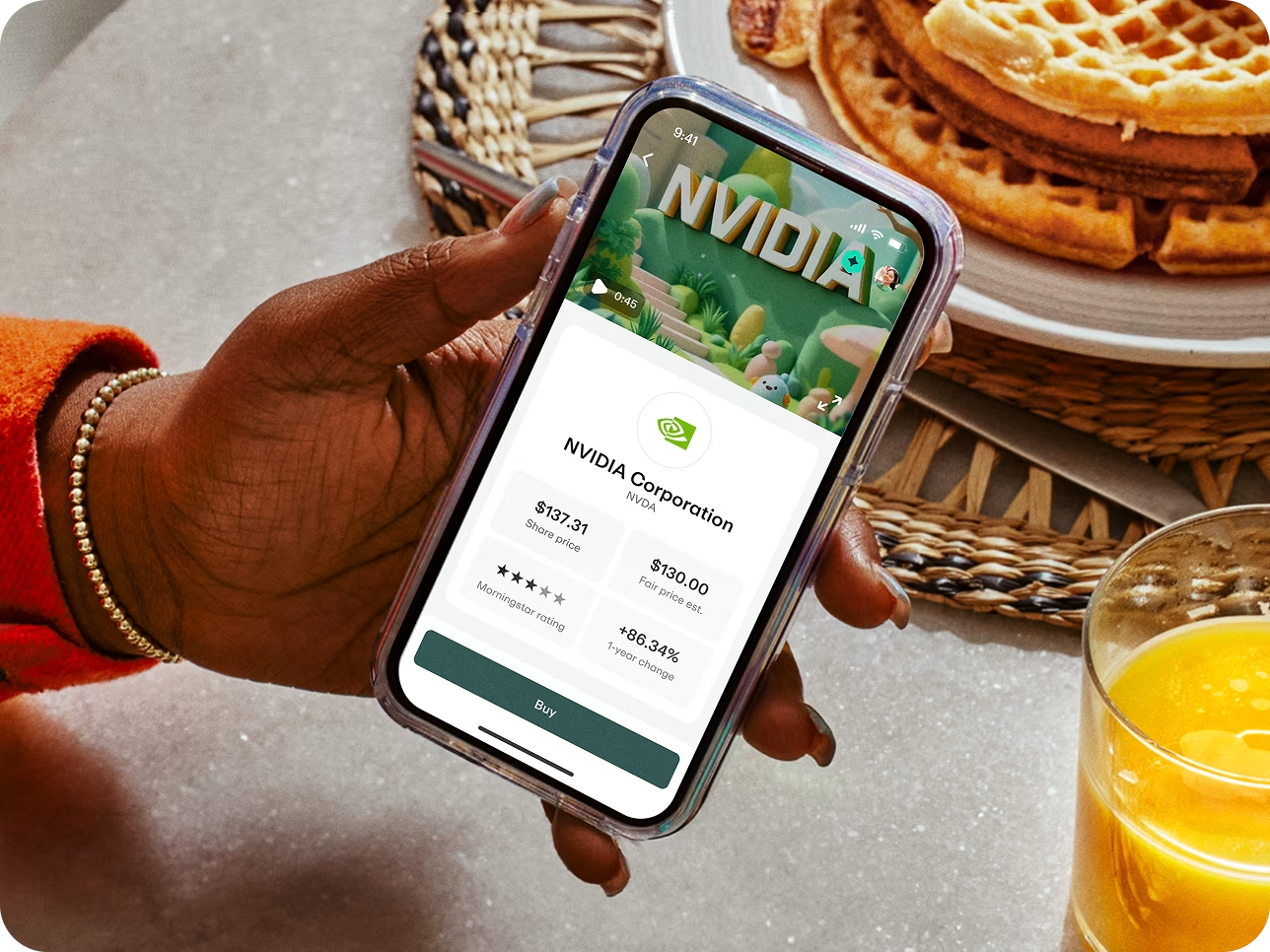

When kids start investing early, they have the chance to grow their money as they save toward all their future goals. New car. College education. First apartment. You name it.

4. FamZoo

Monthly fee

$5.99/mo. or $59.90 annually

Features

Debit card for kids

Chore and allowance checklist

Spend, save, give accounts

Scheduled and instant transfers

Payment splits

Real-time activity alerts

Parent-paid interest

Family billing

Informal loan repayment tracking

Highlights

FamZoo's prepaid debit cards include a parent-loading card alongside cards for your kids and IOU accounts that track money parents hold elsewhere. The no-frills app consists of a family billing system where parents can "charge” kids for shared expenses like cell phone bills or track money borrowed with a parent-defined interest rate.

When deciding which debit card for kids to use, think about what makes the most sense for your family. FamZoo offers a solid basic money management app plus tools like family billing and loan repayment. But, if you’re looking for more robust features like investment tools³, family location sharing, crash detection, drive reports4, and granular parental money controls in addition to money management, Greenlight offers a more flexible, comprehensive suite of options.

5. Venmo for teens

Monthly fee

None

Features

Debit card for teens 13 to 17

Parental account monitoring

No-cost cash withdrawals at in-network ATMs

Early access direct deposit

Fast money transfers

Works wherever Mastercard is accepted

Highlights

Teens and their parents can apply for a free teen debit card and a teen Venmo account. The teen account is a simplified version of an adult Venmo account, allowing teens to securely send and receive money to friends and family. Parents have complete oversight of their teen’s spending — teen account balances can be monitored from the parent Venmo app and parents can lock their teen's debit card at any time plus receive notifications on spending activity.

But, one thing to note is that Venmo's teen offerings don't include a savings account feature — or other money management tools common with other prepaid teen debit cards.

If you just want an easy way to keep track of your teen’s spending and accounts, the Venmo teen debit card and account is a good option to consider. However, Greenlight may be the better choice for families wanting a more comprehensive app that teaches smart saving and spending habits and investing fundamentals³ while maintaining parental control over your child’s accounts. You can also upgrade for expanded family safety features like location sharing and driving reports4.

6. Modak Makers

Monthly fee

None for basic features

Features

Debit card for kids and teens

Customizable parental controls

Financial literacy tools and educational content

Chore and allowance management

Savings goals and rewards

Parental oversight on spending and saving

Highlights

Modak Makers offers a free money management app and debit card for kids and teens. There is savings and spending tracking, chore management, and allowance-based earnings. However, you will pay fees to transfer money, and parental spending controls are limited. Modak Makers is a good choice for families looking for a simple way to teach kids money management through tracking spending, savings, and allowance-based earnings.

Choosing between Greenlight vs. Modak Makers comes down to a cost vs. value consideration. Greenlight offers extensive financial tools, investing options³, and advanced safety features that can grow with your kids as they become teens. But if you prefer a pared-down approach to debit cards for kids and chore/allowance management with no ongoing monthly fees, Modak Makers may be the better pick.

Chores. Allowance. They’re different for every family. That’s why we let you call the shots. Want to tie allowance to chores? Pay a percentage based on chore progress — or only if they’re all done. Prefer not to? Your house. Your rules.

7. Till

Monthly fee

None

Features

Debit card for kids and teens

Chore and allowance management

Savings goals

Parental spending controls

Real-time activity alerts

Highlights

Till gives families a no-cost option for a kids’ debit card paired with simple allowance and chore tools. With Till, parents can send money, set spending limits, and keep an eye on activity with real-time alerts. It’s a good fit for families who want basic controls without an added cost.

Compared to Greenlight, Till doesn’t include savings rewards¹, cash back², or investing³. Greenlight also offers safety tools like location sharing and driving reports4. For families who want a more robust app, Greenlight provides more long-term value and flexibility.

8. Step

Monthly fee

None or $4.99/month

Features

Free basic account with no monthly or overdraft fees

Savings goals and round-ups

Investing in stocks, ETFs, and cryptocurrencies

Early direct deposit

Credit-building option

Highlights

Step positions itself as a teen-friendly banking app with no fees and the ability to build credit when teens are ready. It also includes a debit card, direct deposit, and peer-to-peer payments. For families focused on giving teens early exposure to banking and credit, Step has appeal.

Where it falls short is in parental oversight and learning features. Step also lacks chore management, allowance automation, or customizable parental controls. Greenlight provides these, plus savings rewards¹, cash back², and investing³ for kids, all designed to teach lifelong money skills.

9. Current

Monthly fee

None

Features

Debit card for teens

Instant transfers from parents

Savings Pods for goals

Spending notifications

Recurring allowance

Chore-to-payment connection

Parental oversight

Highlights

Current is another no-fee option with helpful tools for parents and teens. You can transfer money, set up savings Pods for different goals, and get activity alerts. Teens who drive may also benefit from Current’s gas hold removal feature, which reduces those temporary overcharges at the pump.

Current lacks Greenlight’s savings rewards¹, cash back², investing³, and advanced safety features. Greenlight also offers more financial education and protection tools for families.

Level Up learnings give players the confidence to navigate the world of money in real life. With the Greenlight app, kids and teens can put their money skills to work as they learn to earn, save, and invest.

10. Bank of America SafeBalance® for Family Banking

Monthly fee

None

Features

Debit card tied to parent account

Access to Bank of America mobile app

Fraud protection

Parent account monitoring

Highlights

Bank of America allows parents to open bank accounts jointly with their child. Teens can use the Bank of America mobile app, make purchases with a debit card, and set savings goals, while parents retain oversight and control.

Because it’s a traditional bank* account, you won’t find interactive money tools like chores, allowance, or investing. Greenlight is built around teaching kids financial literacy through hands-on features that make it more engaging and flexible than a standard account.

How to choose the right family money app and debit card for kids

It comes down to your family's unique dynamic and needs. Which features do your kids need most? As parents and caregivers, what perks and tools will help you most? Here are a few things to consider when making the choice.

Parental convenience and oversight controls

Flexible parental spend controls

Savings goals

Automated allowance

Chore incentives and task lists

Safety and security features

FDIC insurance for the funds underlying pre-paid debit cards

Strict COPPA adherence (personal information protection)

Location sharing4

Driving reports and SOS alerts4

Earning and growth opportunities

Cash back²

Savings rewards¹

Parent-provided interest

Parent-controlled investing for beginners³

Engaging educational tools

Chores and allowance automation

Games and interactive features

Financial literacy resources that foster smart money management skills

If you only need a basic debit card for kids and teens, a free prepaid card is a good place to start. If you want a kids' debit card with more parental controls and financial literacy tools that teach kids how to earn, save, spend, and invest long-term, consider one of the fee-based family money apps.

Whichever end of the spectrum you decide, you want to protect your kids and your family's money. As you compare debit cards, look for these critical basics and valuable extras.

The bottom line

These Greenlight alternatives deliver similar core features (e.g., pre-paid debit card, parent funding, allowance automation). Where they differ is in price, features, and overall value.

If you just want a basic debit card for kids and teens, one of these free or lower monthly fee providers may be right for you. But there's much more to building lifelong money management skills than opening an account.

Robust family money apps like Greenlight can make life easier for parents by teaching – and protecting – kids and teens while they gain financial independence. For a few bucks a month, Greenlight delivers an invaluable toolkit of rich features, perks, and capabilities that similarly priced apps don't offer, including:

Up to 6% on savings¹

Up to 1% cash back²

Customizable parent controls like category and store-specific spending limits

Schedule chores and approve task-related payments

Automatic allowance payments

Divide funds between spending, giving, and saving

Investing for beginners w/parent controls and low $1 bid options³

In-app financial literacy game, Level Up™

Learning Center blog and expert resources

Advanced safety features like location tracking, driving reports, crash detection4, and phone5, purchase, and identity theft protection

Greenlight excels in benefits, flexibility, safety, and real-time personal finance education. Designed specifically for families, Greenlight is an excellent way for kids, tweens, and teens to gain hands-on experience in saving, spending, and money management skills with a parental safety net.

Both you and your kids download the Greenlight app — with tailored experiences. They check off chores, you automate allowance. They spend wisely, you set flexible controls. They build healthy financial habits, and you cheer them on.

Join Greenlight. Love it or it's on us.†

Plans start at just $5.99/month for the whole family. Includes up to five kids.

Read how we use and collect your information by visiting our Privacy Statement.